Unlock Your Small Business Retirement Exemption: Maximize Savings For A Secure Future

Small Business Retirement Exemption: A Path to Financial Freedom

Imagine a life where you can retire comfortably, free from financial worries, and with the confidence that your small business has provided you with a secure future. This dream can become a reality with the Small Business Retirement Exemption (SBRE). As a small business owner myself, I have had firsthand experience with this exceptional program and its numerous benefits. In this article, I will delve into the ins and outs of the SBRE, providing you with valuable insights and practical tips to make the most of this retirement exemption.

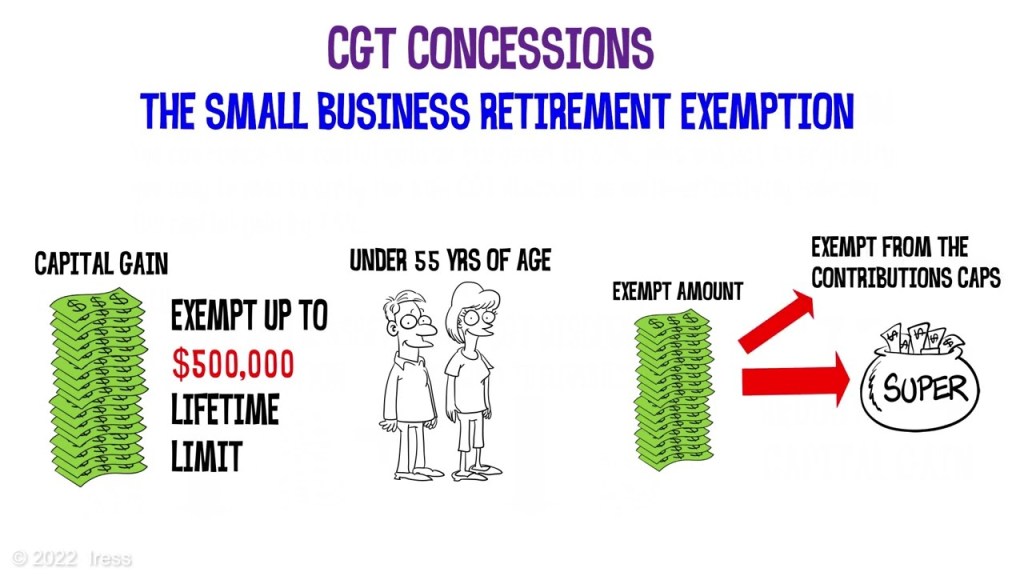

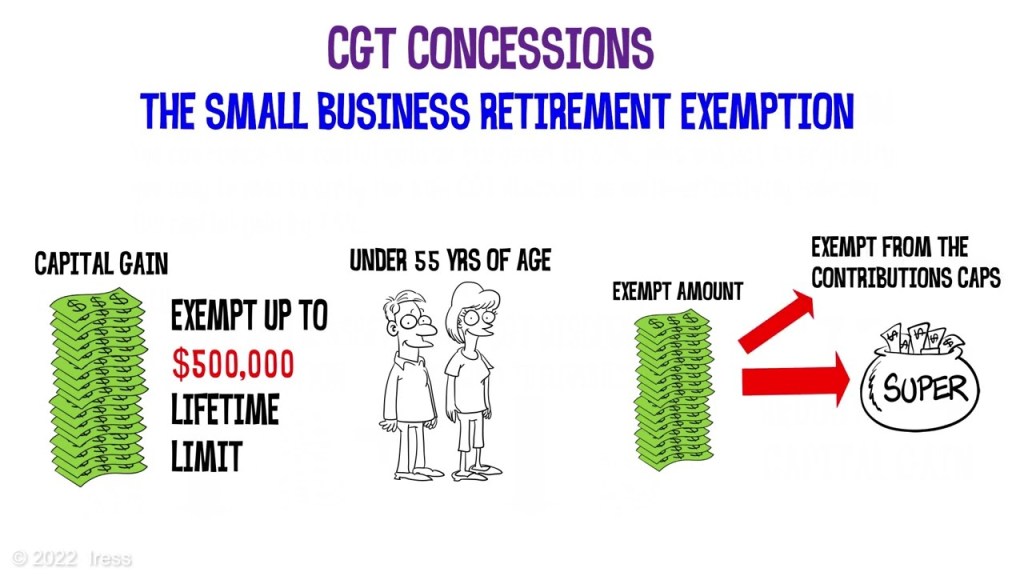

What is the Small Business Retirement Exemption?

The Small Business Retirement Exemption is a program introduced by the government to assist small business owners in planning for their retirement. It allows eligible individuals to contribute a portion of their business profits into a retirement savings account, free from taxation. This exemption serves as a powerful incentive for entrepreneurs to invest in their future while also stimulating the growth of small businesses.

1 Picture Gallery: Unlock Your Small Business Retirement Exemption: Maximize Savings For A Secure Future

Who is Eligible for the SBRE?

Small business owners who are sole proprietors, partnerships, or involved in unincorporated small businesses may be eligible for the SBRE. To qualify, you need to meet specific criteria set by the government, such as having an annual aggregate turnover below a certain threshold. It is crucial to consult a financial advisor or visit the official government website to determine your eligibility and understand the requirements in your jurisdiction.

When and Where Can You Benefit from the SBRE?

Image Source: ytimg.com

The SBRE is available in various countries, each with its own specific regulations and timelines. In Australia, for example, this retirement exemption was introduced in 2016 and has since helped countless small business owners plan for their future. Other countries, such as the United States and Canada, offer similar programs tailored to their respective economic landscapes. It is essential to research and understand the retirement exemption options available in your country to take full advantage of this opportunity.

Why Should You Consider the SBRE?

The Small Business Retirement Exemption offers numerous advantages that make it an attractive option for small business owners looking to secure their financial future. Firstly, it allows you to maximize your retirement savings by contributing a portion of your business profits without incurring taxes. This tax-deferred growth can significantly enhance the growth of your retirement nest egg. Additionally, the SBRE provides a sense of security, knowing that you will have a stable income stream during your golden years.

Furthermore, the SBRE promotes entrepreneurship and stimulates economic growth. By incentivizing small business owners to invest in their retirement, it encourages individuals to take calculated risks and pursue their entrepreneurial dreams. This, in turn, creates job opportunities and contributes to the overall prosperity of the economy.

How Does the SBRE Work?

Image Source: imgix.net

The SBRE operates by allowing eligible small business owners to contribute a portion of their business profits into a retirement savings account. These contributions are made on a pre-tax basis, meaning they are deducted from your taxable income. The funds in your retirement account can then be invested in various asset classes, such as stocks, bonds, or real estate, to grow your wealth over time. This tax-efficient structure ensures that your retirement savings have the potential to compound and grow exponentially.

Frequently Asked Questions about the SBRE

Q: Can I contribute to the SBRE if I have employees?

A: Yes, the SBRE allows contributions even if you have employees. However, there may be additional considerations and requirements, such as providing equivalent benefits to your employees.

Q: Are there limitations on the amount I can contribute to the SBRE?

A: Yes, there are caps on the amount you can contribute to the SBRE. It is crucial to consult the specific regulations in your country to understand the limits and maximize your contributions within the set boundaries.

Q: Can I access the funds in my retirement account before I reach retirement age?

A: Generally, the funds in your retirement account are meant to be accessed after reaching retirement age. However, there may be circumstances where early withdrawals are permitted, such as financial hardship or specific medical expenses. It is essential to consult with a financial advisor to understand the rules and potential implications of early withdrawals.

Conclusion: A Bright Future with the SBRE

The Small Business Retirement Exemption presents a unique opportunity for small business owners to secure their financial future while enjoying the benefits of entrepreneurship. By taking advantage of this retirement exemption, you can maximize your retirement savings, free from taxation, and create a pathway to financial freedom. As someone who has experienced the advantages firsthand, I highly recommend exploring the SBRE and consulting with financial professionals to tailor a retirement plan that suits your specific needs. With the SBRE, the golden years of retirement can truly be golden.

This post topic: Small Business