Unlock Your Small Business Potential With Scotland’s Small Business Rates Relief: Take Action Today!

Small Business Rates Relief in Scotland: A Lifeline for Local Businesses

Introduction:

As a passionate reviewer and advocate for small businesses, I am excited to share my experience and insights regarding the Small Business Rates Relief (SBRR) in Scotland. SBRR is a crucial initiative that aims to support local businesses by alleviating their financial burden and enabling them to thrive in a competitive market. In this article, I will provide a comprehensive overview of SBRR, its benefits, and how it has positively impacted small businesses in Scotland.

3 Picture Gallery: Unlock Your Small Business Potential With Scotland’s Small Business Rates Relief: Take Action Today!

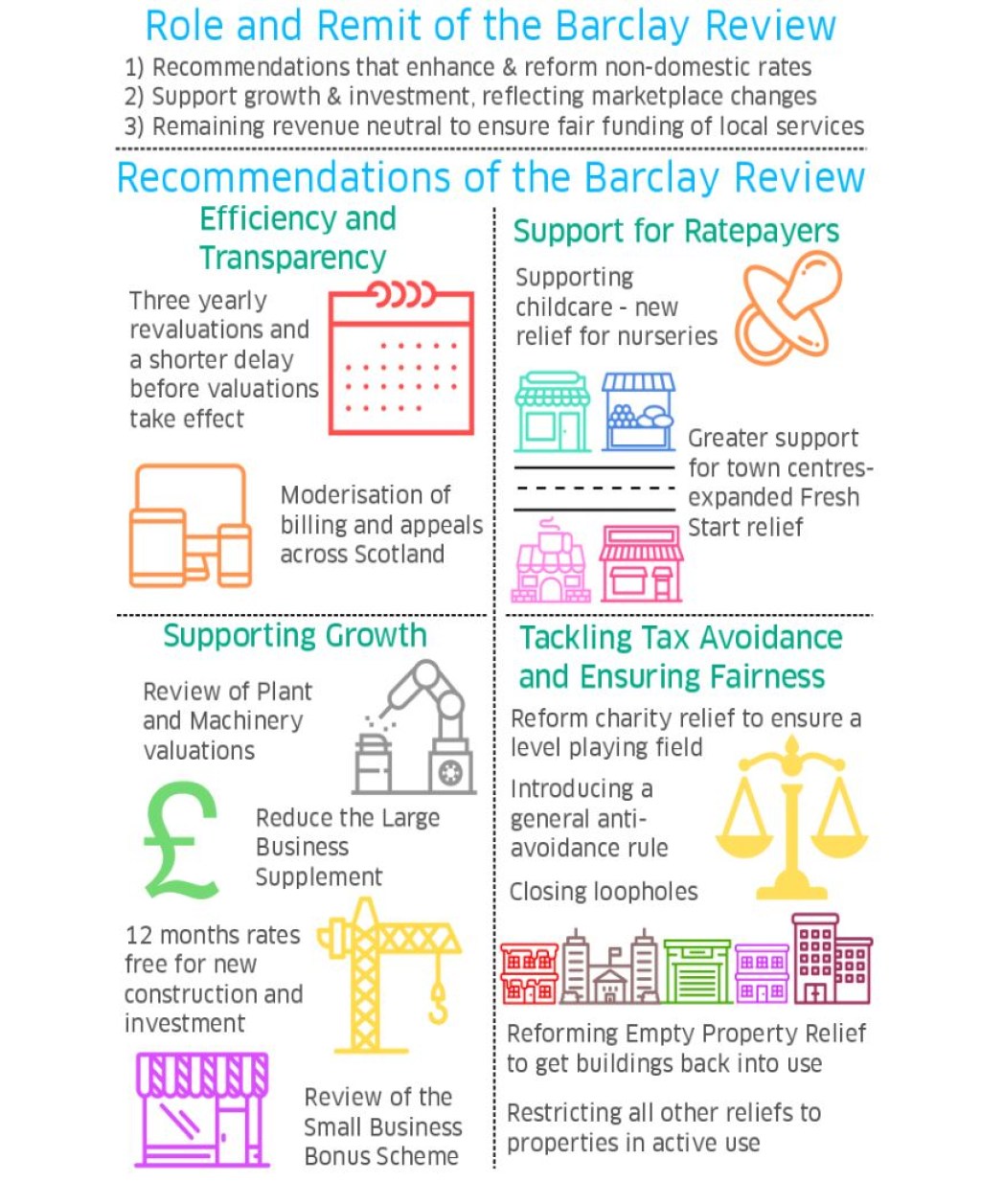

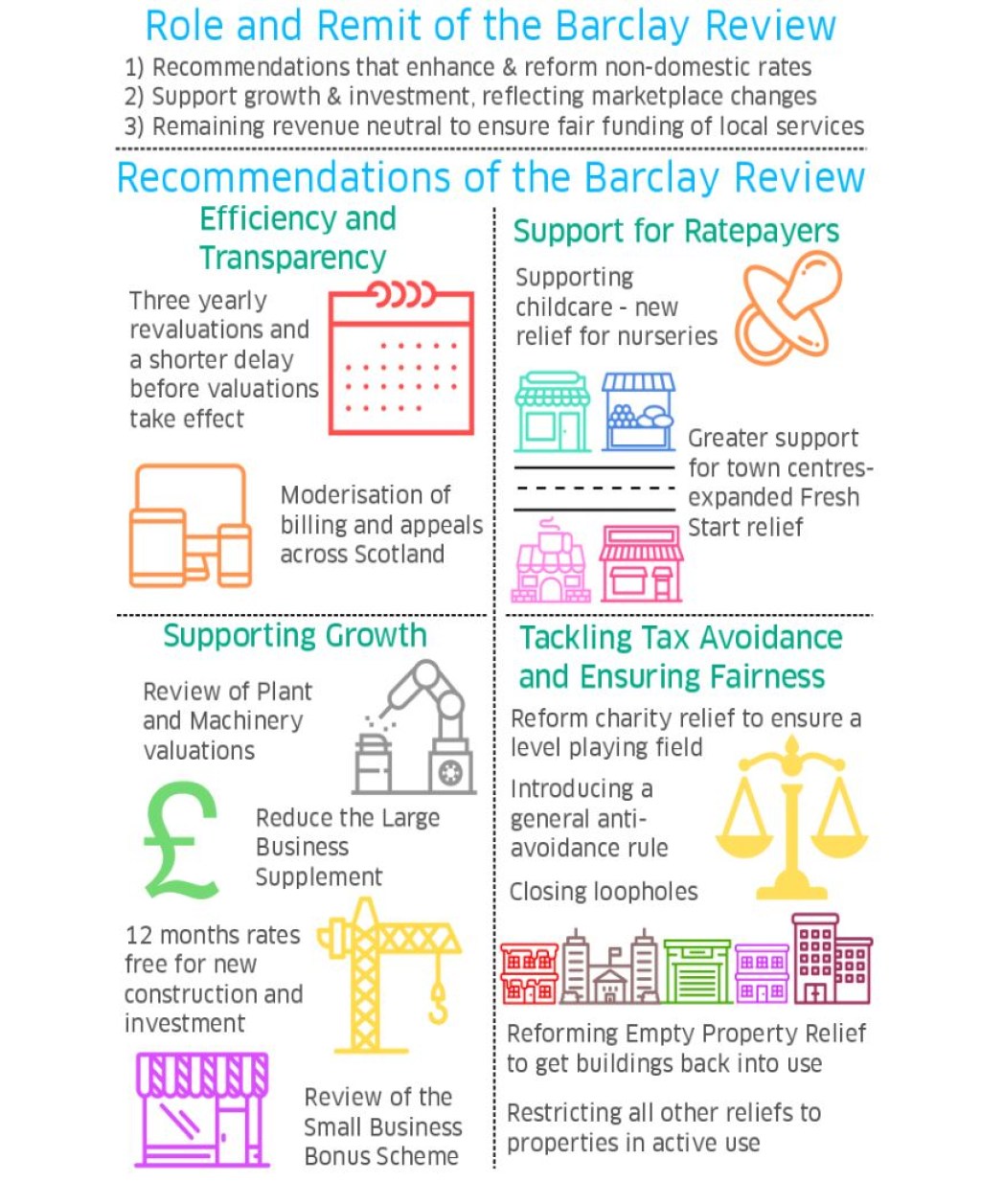

What is Small Business Rates Relief (SBRR)?

SBRR is a government scheme in Scotland that offers relief on non-domestic rates to eligible small businesses. This relief is aimed at reducing the financial strain faced by small enterprises and encouraging their growth and sustainability. The relief is provided in the form of discounts or exemptions from business rates, depending on the property’s rateable value and the eligibility criteria.

Who Qualifies for SBRR?

Image Source: wordpress.com

SBRR is available to various types of businesses, including shops, offices, pubs, restaurants, and other commercial properties. To qualify for SBRR, a business must meet certain requirements, such as having only one property, a rateable value below a specified threshold, and using the property for business purposes. The relief is primarily targeted at small businesses with limited resources, aiming to level the playing field and support local entrepreneurship.

When and Where Can Businesses Apply for SBRR?

Businesses can apply for SBRR at any time during the year, and the relief is granted for the duration of the financial year. Applications can be submitted online through the Scottish government’s official website or by contacting the local council. It is essential to keep track of the application deadlines to ensure timely submission and avail the benefits without any interruptions.

Why is SBRR Essential for Small Businesses in Scotland?

Small businesses play a vital role in the Scottish economy, contributing to job creation, innovation, and community development. However, they often face significant challenges, including high operating costs and fierce competition from larger establishments. SBRR provides much-needed relief, allowing small businesses to allocate their limited resources towards growth, hiring employees, and enhancing customer experiences. With reduced financial burdens, businesses can focus on delivering quality products and services, thus fostering a vibrant local economy.

How Does SBRR Work in Practice?

Image Source: gov.scot

SBRR operates by providing relief in the form of discounts or exemptions on non-domestic rates. The amount of relief depends on the rateable value of the property. For properties with a rateable value up to £15,000, the relief is 100%, meaning the business pays no rates. For properties with a rateable value between £15,001 and £18,000, there is a sliding scale of relief, gradually decreasing as the rateable value increases. The relief gradually tapers off for properties with a rateable value between £18,001 and £35,000.

Frequently Asked Questions (FAQ) about SBRR:

Q: Can businesses with multiple properties apply for SBRR?

A: No, SBRR is applicable to businesses with only one property.

Image Source: amazonaws.com

Q: What happens if a business exceeds the threshold rateable value during the financial year?

A: If a business surpasses the threshold rateable value, it will lose its eligibility for SBRR from the next financial year onwards.

Q: Are there any additional requirements or documentation needed to apply for SBRR?

A: Businesses may be required to provide supporting documents, such as proof of occupation and business rates bills, during the application process.

The Value of SBRR for Small Businesses:

The SBRR scheme has proven to be a lifeline for small businesses in Scotland, offering them a helping hand in a competitive market. By reducing their financial burdens, SBRR enables businesses to invest in their growth, hire local talent, and expand their operations. Additionally, it fosters a sense of community and supports local entrepreneurship, contributing to the overall economic development of Scotland.

The Pros and Cons of SBRR:

Pros:

Financial relief for small businesses

Encourages growth and sustainability

Promotes job creation and local employment

Fosters a vibrant local economy

Cons:

Eligibility criteria may restrict some businesses

Relief amount decreases with higher rateable values

Annual application process requires vigilance

Conclusion:

Small Business Rates Relief in Scotland is a game-changer for local businesses, offering them a lifeline to navigate the competitive market landscape. By reducing their financial burdens, SBRR promotes entrepreneurship, job creation, and economic growth. It empowers small businesses to focus on delivering quality products and services, fostering a thriving local economy. As a passionate supporter of small businesses, I highly recommend SBRR to all eligible enterprises in Scotland. Apply today and experience the transformative benefits of this vital initiative!

This post topic: Small Business