Unlock Your Potential With A Small Business Loan: Boost Your Success With A 600 Credit Score!

Small Business Loan 600 Credit Score: Unlocking Opportunities for Entrepreneurs

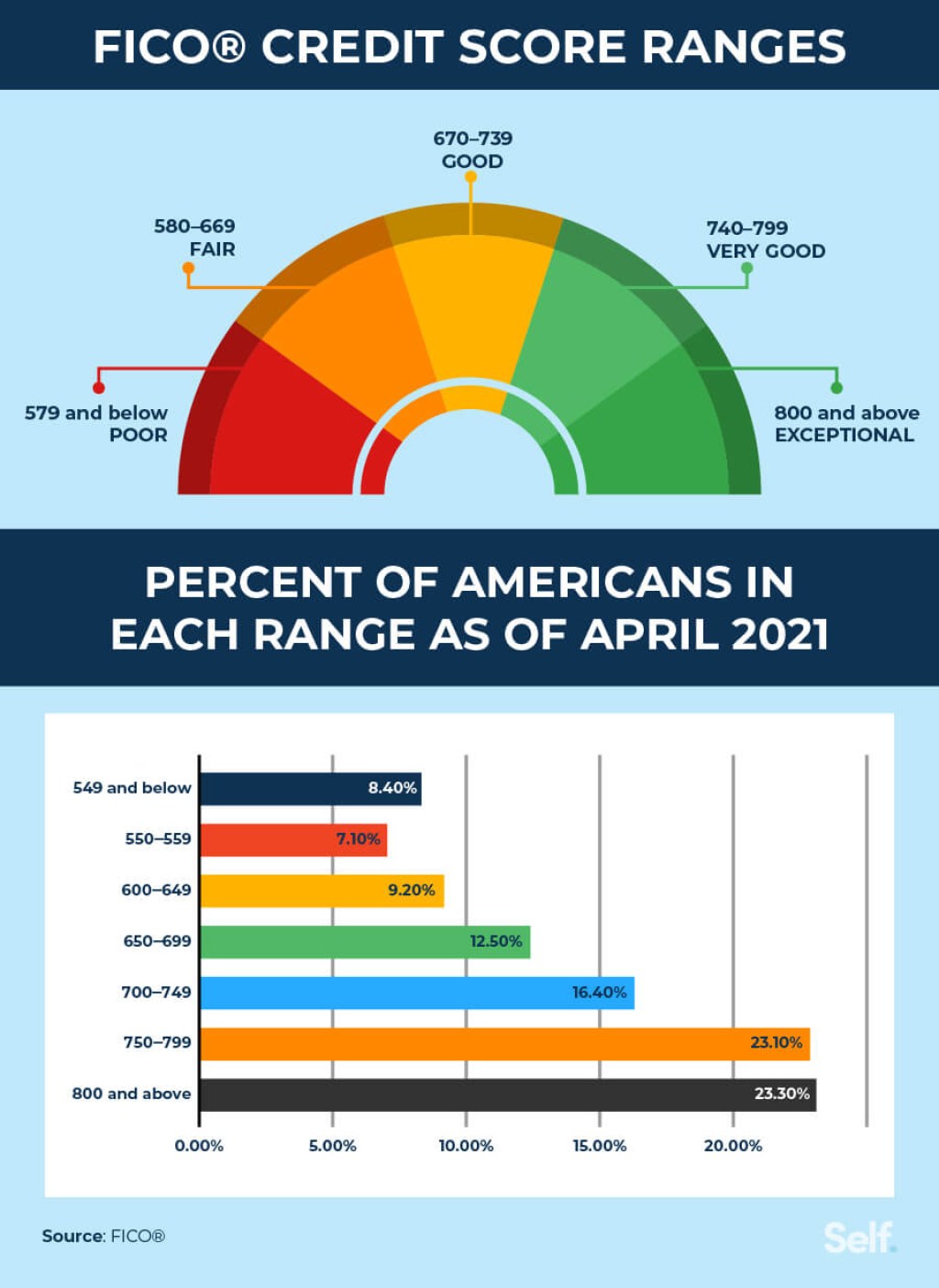

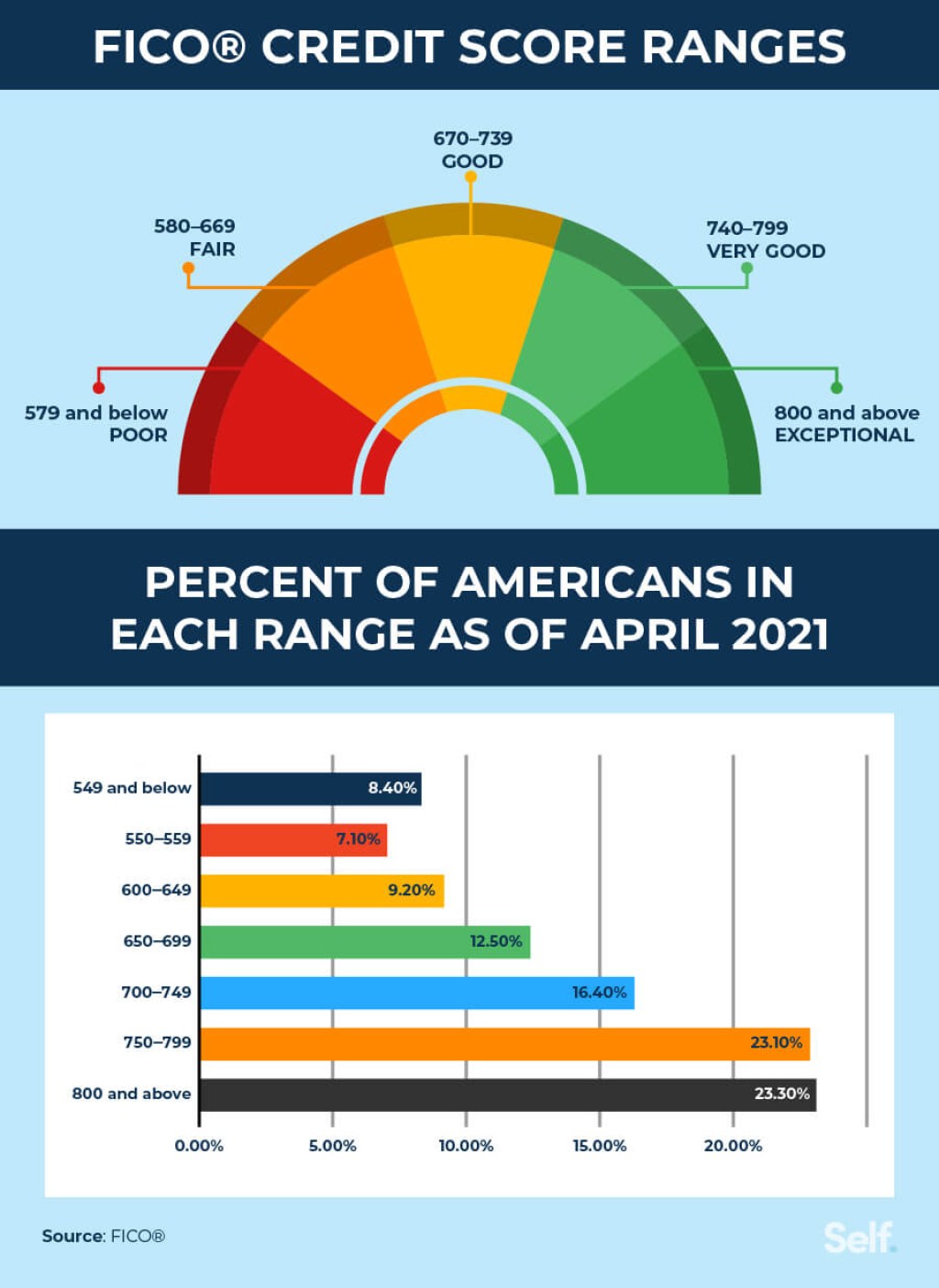

Starting a small business can be an exciting endeavor, but it often requires a significant amount of capital. While some entrepreneurs may have the necessary funds to kickstart their ventures, others may need financial assistance. This is where small business loans come into play. In this article, I will explore the world of small business loans specifically designed for individuals with a credit score of 600. With the right loan, entrepreneurs with a less-than-perfect credit score can still realize their dreams and turn their business ideas into reality.

What is a Small Business Loan?

A small business loan is a form of financing tailored for entrepreneurs who need funds to establish or expand their businesses. The loan amount can vary depending on the lender and the borrower’s needs. These loans typically come with fixed interest rates and repayment terms that are suitable for small businesses.

3 Picture Gallery: Unlock Your Potential With A Small Business Loan: Boost Your Success With A 600 Credit Score!

Who Can Apply for a Small Business Loan with a 600 Credit Score?

Individuals with a credit score of 600 may find it challenging to secure traditional loans from banks or financial institutions. However, there are lenders who specialize in providing small business loans to borrowers with lower credit scores. These lenders understand that credit scores do not necessarily reflect an individual’s ability to run a successful business. By considering other factors such as business revenue and potential, they offer opportunities to entrepreneurs who have been turned away by traditional lenders.

When Should You Consider a Small Business Loan with a 600 Credit Score?

Image Source: credible.com

If you have a credit score of 600 and are looking to start a small business or expand an existing one, a small business loan can be a viable option. It can provide the necessary capital to invest in equipment, inventory, marketing, or hiring employees. By securing a loan, you can overcome the financial barriers that may be holding you back from achieving your business goals.

Where Can You Find Small Business Loans for a 600 Credit Score?

There are several online lenders and alternative financing platforms that cater specifically to individuals with lower credit scores. These lenders offer small business loans with varying terms and conditions. It’s crucial to research and compare different lenders to find the one that best suits your needs. Some popular online lenders include OnDeck, Kabbage, and Fundbox.

Why Choose a Small Business Loan with a 600 Credit Score?

While it may seem unfavorable to have a credit score of 600, opting for a small business loan specifically designed for individuals with lower credit scores can be advantageous. These loans provide an opportunity for entrepreneurs to access the capital they need to start or grow their businesses. They also give borrowers the chance to improve their credit scores by making timely repayments, which can open doors to more favorable financing options in the future.

How Can You Improve Your Chances of Approval for a Small Business Loan with a 600 Credit Score?

Image Source: ctfassets.net

Although lenders specializing in small business loans for 600 credit scores are more lenient, there are still ways to improve your chances of approval. Here are some tips:

1. Build a solid business plan: A well-prepared business plan showcases your vision, market research, and projected financials, making you a more attractive borrower.

Image Source: ctfassets.net

2. Demonstrate business revenue: If your business is already generating revenue, providing evidence of steady cash flow can increase your chances of approval.

3. Offer collateral: Putting up collateral, such as personal or business assets, can provide lenders with additional security and boost your loan application.

4. Seek a co-signer: Having a co-signer with a higher credit score can strengthen your loan application and increase the likelihood of approval.

FAQs

Q: Are there limits on how I can use a small business loan?

A: While different lenders may have specific restrictions, small business loans are generally flexible and can be used for various purposes, such as purchasing inventory, equipment, or marketing.

Q: How long does it take to get approved for a small business loan?

A: The approval process can vary depending on the lender and the complexity of your application. It can take anywhere from a few days to a few weeks.

Q: Can I get a small business loan with bad credit?

A: Yes, there are lenders who specifically cater to borrowers with bad credit. However, keep in mind that the terms and interest rates may be less favorable compared to borrowers with good credit.

Conclusion

Securing a small business loan with a credit score of 600 may seem challenging, but it is not impossible. By exploring lenders specializing in loans for lower credit scores, entrepreneurs can access the capital needed to start or expand their businesses. It’s essential to research and compare lenders to find the best option for your specific needs. With the right loan and a solid business plan, entrepreneurs can turn their dreams into reality and embark on a journey of entrepreneurial success.

This post topic: Small Business