Unlock Success With A Small Business Loan Of $60,000: Empower Your Growth Today!

Small Business Loan 60000: Empowering Businesses to Reach New Heights

Starting a small business is an endeavor that requires not only hard work and dedication but also a solid financial foundation. However, many aspiring entrepreneurs struggle to secure the necessary funds to turn their dreams into reality. This is where small business loans come into play. In this article, we will delve into the world of small business loans, with a focus on the benefits and opportunities provided by a loan of 60000 dollars.

What is a Small Business Loan?

A small business loan is a loan specifically designed to provide financial assistance to small businesses. These loans are typically offered by banks, credit unions, or alternative lending institutions. The funds can be used for various purposes, such as starting a new business, expanding an existing one, purchasing inventory, or investing in equipment. Small business loans come in different amounts, terms, and interest rates, allowing entrepreneurs to choose the option that best suits their needs.

3 Picture Gallery: Unlock Success With A Small Business Loan Of $60,000: Empower Your Growth Today!

Who Qualifies for a Small Business Loan?

Qualifying for a small business loan is dependent on several factors. Lenders typically evaluate the creditworthiness of the borrower, including their personal and business credit score, financial history, and business plan. Additionally, lenders may require collateral, such as property or inventory, to secure the loan. While each lender has its own criteria, it is essential for applicants to demonstrate a solid business plan, a reliable source of income, and the ability to repay the loan within the specified timeframe.

When Should You Consider a Small Business Loan?

Image Source: aib.ie

There are various situations in which a small business loan can be beneficial. Some common scenarios include:

Starting a new business: A small business loan can provide the necessary capital to launch a new venture and cover initial expenses, such as equipment, inventory, and marketing.

Expanding an existing business: If your business is experiencing growth and requires additional resources, a loan can help finance expansions, such as opening a new location or hiring more employees.

Purchasing inventory: For businesses that rely on inventory, a loan can assist in purchasing large quantities of stock to meet customer demand.

Investing in equipment: Upgrading or purchasing new equipment can enhance operational efficiency and productivity. A small business loan can provide the funds needed for such investments.

Where Can You Obtain a Small Business Loan?

Image Source: justinepetersen.org

Small business loans are available from a variety of sources, including:

Traditional banks: Banks offer small business loans with competitive interest rates and comprehensive loan packages.

Credit unions: Credit unions are member-owned financial institutions that often provide favorable loan terms and personalized services.

Online lenders: Online lending platforms have gained popularity in recent years, offering quick and convenient loan applications and approvals.

Government agencies: Government-backed loans, such as those offered by the Small Business Administration (SBA), provide additional support and resources for small business owners.

Why Should You Consider a Small Business Loan of 60000 Dollars?

Image Source: fundingcircle.com

A small business loan of 60000 dollars can provide significant opportunities for entrepreneurs. Here are some reasons why you should consider this loan amount:

Reasonable amount: 60000 dollars is a substantial sum that can cover various business expenses, allowing for growth and development.

Flexible terms: Lenders offer a range of repayment terms to suit your business’s cash flow and financial capabilities.

Competitive interest rates: With a strong credit profile, you can secure a small business loan with favorable interest rates, minimizing your overall borrowing costs.

Opportunity for expansion: The funds from a 60000-dollar loan can enable you to expand your operations, reach new markets, and increase your customer base.

How Can You Maximize the Benefits of a Small Business Loan?

While a small business loan can be a valuable tool, it is crucial to use the funds wisely. Here are some tips to maximize the benefits:

Create a detailed business plan: A well-crafted business plan showcases your vision, strategy, and financial projections, increasing your chances of loan approval.

Research and compare lenders: Take the time to explore different lenders, comparing their loan terms, interest rates, and customer reviews. This ensures you choose the best fit for your business.

Use the funds strategically: Invest the loan amount in areas that will generate a positive return on investment, such as marketing, product development, or infrastructure improvements.

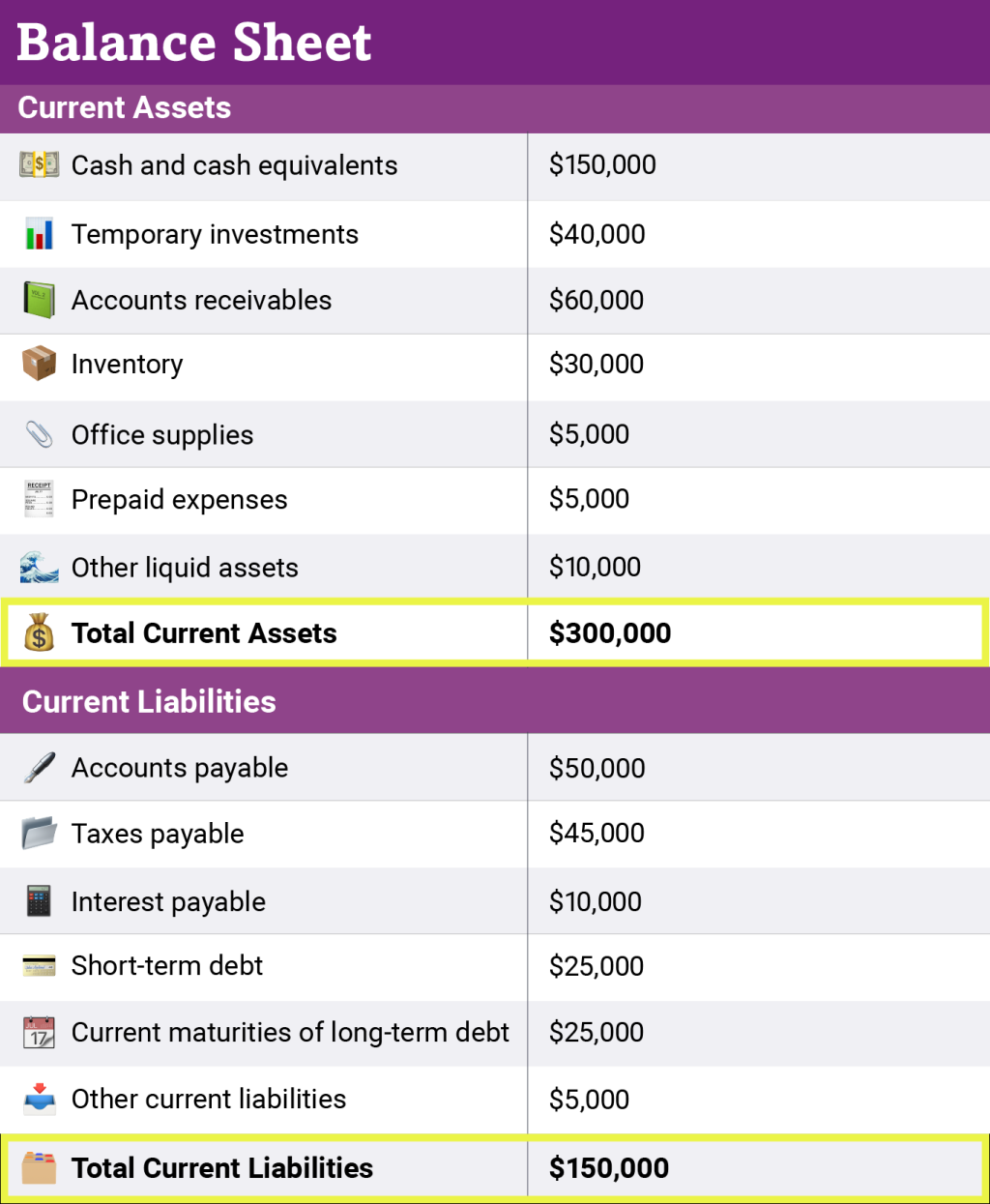

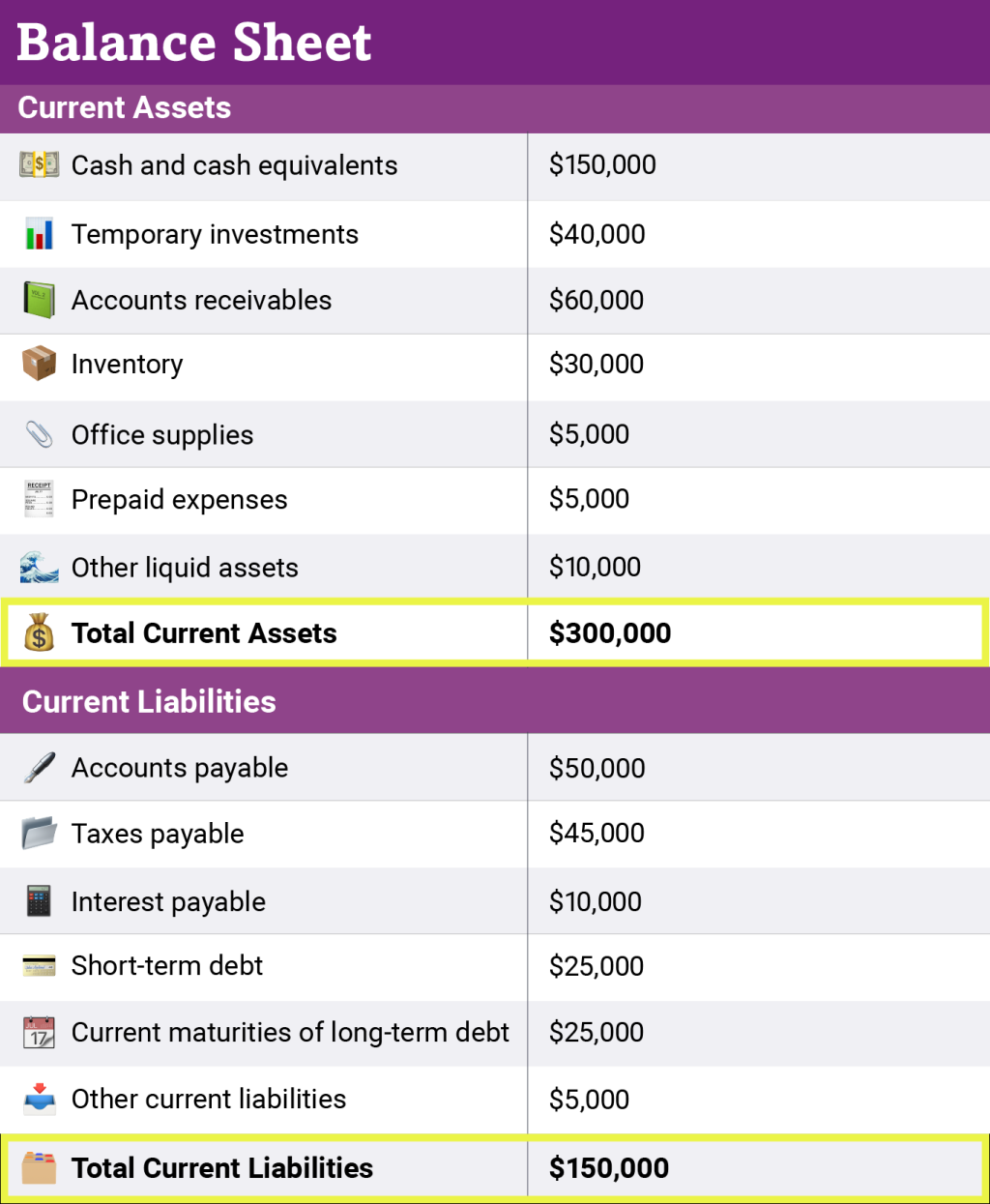

Monitor your cash flow: Regularly review your financial statements to track your business’s performance and ensure you can meet your loan repayment obligations.

Frequently Asked Questions (FAQs)

1. Can I qualify for a small business loan if I have bad credit?

While a poor credit score can make it more challenging to obtain a small business loan, it is not impossible. Some lenders specialize in providing loans to businesses with subpar credit. However, expect higher interest rates or additional collateral requirements.

2. How long does it take to get approved for a small business loan?

The approval process for a small business loan can vary depending on the lender. Traditional banks may have longer processing times, while online lenders often offer faster approvals, sometimes within a few days.

3. What happens if I default on my small business loan?

If you are unable to make your loan payments as agreed, it can have severe consequences. Defaulting on a small business loan can damage your credit score, result in legal action, and potentially lead to the loss of assets used as collateral.

4. Are there any alternatives to small business loans?

Yes, there are alternative financing options available for small businesses, such as lines of credit, business credit cards, crowdfunding, or seeking investments from angel investors or venture capitalists. Each option has its own advantages and considerations.

Conclusion: A Gateway to Success

Small business loans, including a loan of 60000 dollars, can be a game-changer for aspiring entrepreneurs and established businesses alike. With the right funding, businesses can seize opportunities, overcome challenges, and achieve their goals. However, it is essential to approach borrowing responsibly, understanding the terms, and utilizing the funds wisely. By doing so, small business owners can navigate the path to success and prosperity.

This post topic: Small Business