Unlock Your Small Business Potential With The 100% Tax Deduction Advantage: Act Now!

Small Business 100 Tax Deduction: Maximizing Savings for Entrepreneurs

Introduction: As a small business owner, one of the most important aspects of managing finances is understanding tax deductions. These deductions can significantly reduce taxable income and help entrepreneurs save money. Among the various deductions available, the Small Business 100 Tax Deduction stands out as a key opportunity for maximizing savings. In this article, we will explore the ins and outs of this deduction, providing insights, tips, and tricks for small business owners to take full advantage of this tax benefit.

What is the Small Business 100 Tax Deduction?

The Small Business 100 Tax Deduction is a tax benefit specifically designed to support and promote entrepreneurship. It allows small business owners to deduct 100% of their business expenses from their taxable income. This deduction is applicable to a wide range of business expenses, such as office supplies, advertising costs, professional fees, and even travel expenses.

3 Picture Gallery: Unlock Your Small Business Potential With The 100% Tax Deduction Advantage: Act Now!

Who Qualifies for the Small Business 100 Tax Deduction?

The Small Business 100 Tax Deduction is available to individuals and entities that meet the criteria of being classified as a small business. Typically, this refers to businesses with fewer than 500 employees and a certain level of annual revenue. However, it is important to consult with a tax professional or refer to the IRS guidelines to determine eligibility based on specific circumstances.

When and Where Can I Claim the Small Business 100 Tax Deduction?

Image Source: weltbild.de

The Small Business 100 Tax Deduction can be claimed annually during the tax filing season. Small business owners can include their deductible expenses on their tax returns, using Schedule C or other applicable forms. It is crucial to keep accurate records and receipts of all business expenses to support the deduction.

Why Should Small Business Owners Take Advantage of This Deduction?

The Small Business 100 Tax Deduction offers significant benefits for entrepreneurs. By deducting 100% of their business expenses, small business owners can lower their taxable income, resulting in lower overall tax liability. This deduction provides an opportunity for entrepreneurs to reinvest their savings back into their business, fueling growth and innovation.

How Can Small Business Owners Maximize the Small Business 100 Tax Deduction?

To maximize the Small Business 100 Tax Deduction, small business owners should follow these essential tips:

1. Keep Detailed Records:

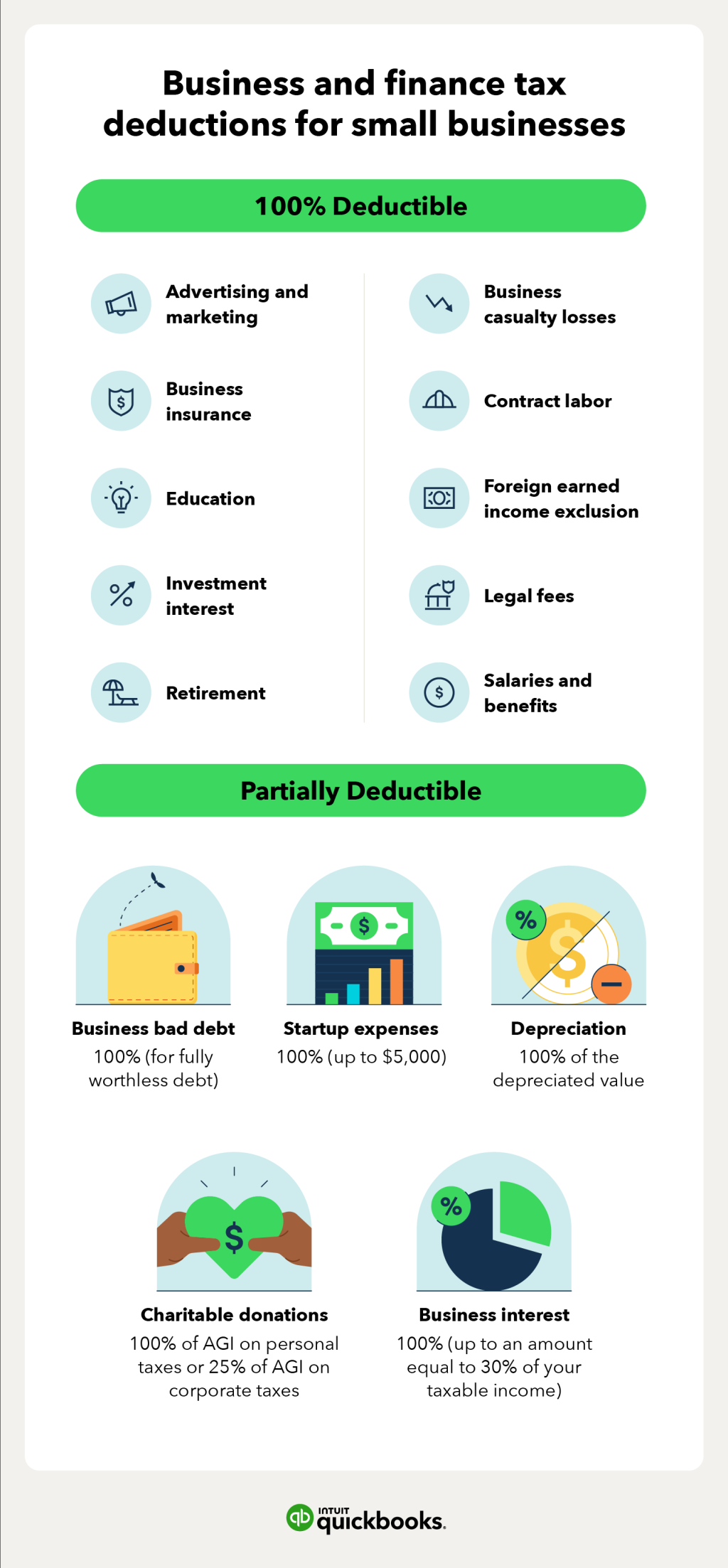

Image Source: intuit.com

Maintain accurate and organized records of all business expenses. This includes invoices, receipts, and any other relevant documentation that proves the expenses are legitimate and related to the business.

2. Understand Eligible Expenses:

Familiarize yourself with the list of eligible expenses for the Small Business 100 Tax Deduction. This will help ensure that you do not miss out on any deductible expenses and maximize your tax savings.

3. Seek Professional Guidance:

Consulting with a knowledgeable tax advisor or accountant can be invaluable. They can provide guidance on tax planning strategies, help identify deductible expenses, and ensure compliance with tax regulations.

4. Separate Personal and Business Expenses:

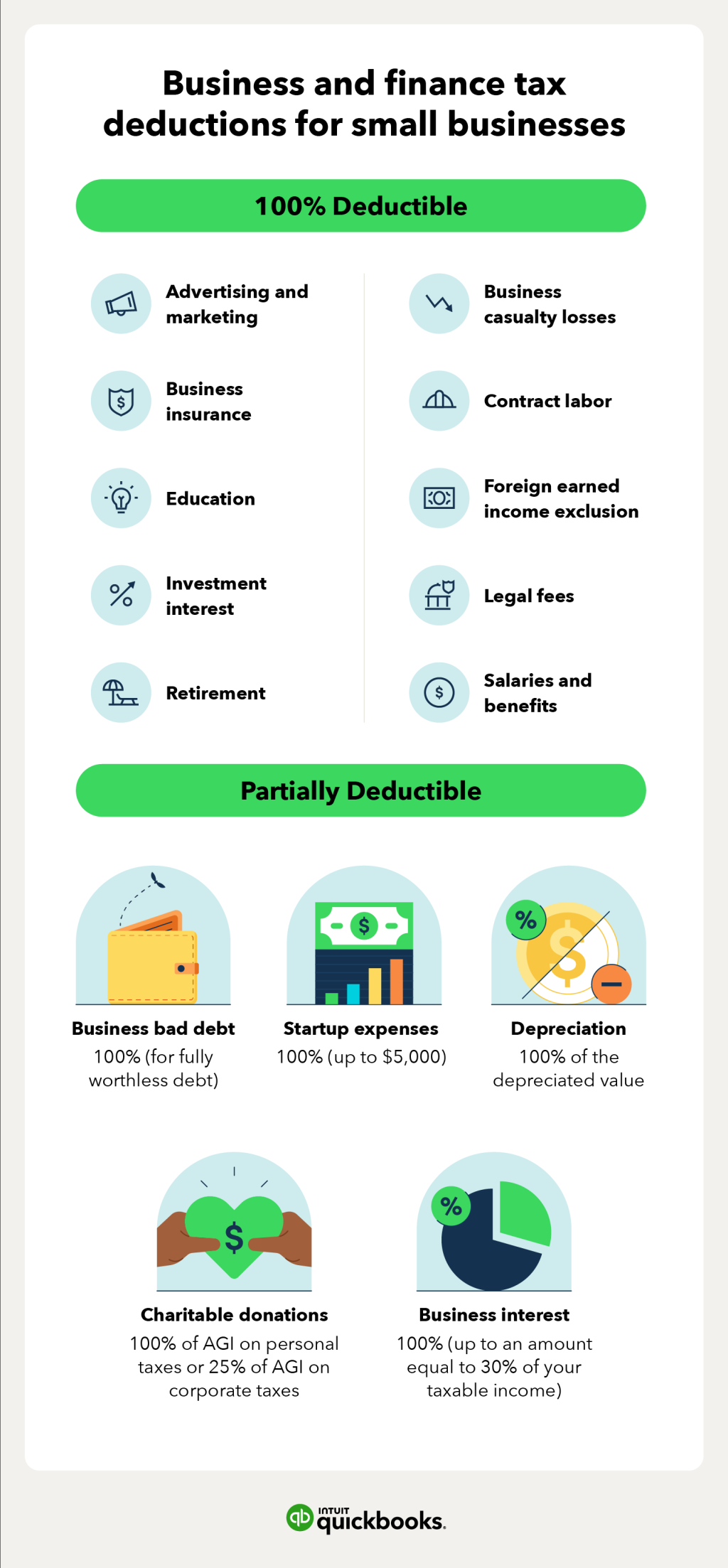

Image Source: intuit.com

It is crucial to keep personal and business expenses separate. This will not only make it easier to track deductible expenses but also help avoid any potential issues during tax audits.

FAQs about the Small Business 100 Tax Deduction

Q: Are there any limitations to the Small Business 100 Tax Deduction?

A: While the deduction allows for 100% of eligible business expenses to be deducted, there may be specific limitations based on the type of expense or industry. It is important to review the IRS guidelines and consult with a tax professional for specific details.

Q: Can I claim the Small Business 100 Tax Deduction if I am a sole proprietor?

A: Yes, sole proprietors are eligible for this deduction. They can claim the deduction on their personal tax returns using Schedule C.

Q: Is there a maximum limit for the Small Business 100 Tax Deduction?

A: No, there is no maximum limit. Small business owners can deduct 100% of eligible expenses, subject to IRS guidelines and regulations.

Conclusion

In conclusion, the Small Business 100 Tax Deduction is a powerful tool for small business owners to maximize their savings. By deducting 100% of eligible business expenses from taxable income, entrepreneurs can significantly reduce their tax liability and reinvest the savings back into their businesses. However, it is crucial to understand the eligibility criteria, keep accurate records, and seek professional guidance to ensure compliance and take full advantage of this tax benefit. With careful planning and utilization of the Small Business 100 Tax Deduction, entrepreneurs can drive financial success and fuel their business growth.

This post topic: Small Business