Safeguard Your Small Business With Comprehensive 3rd Party Insurance: Secure Your Future Today!

Protect Your Small Business with 3rd Party Insurance

As a small business owner, ensuring the protection of your business is of utmost importance. One aspect that cannot be overlooked is third-party insurance. This type of insurance provides coverage for any liabilities or damages that may arise from the actions or operations of your business, protecting both you and your customers in the process. In this article, I will share my personal experience and insights on small business third-party insurance, discussing its importance, benefits, and everything you need to know.

What is Small Business 3rd Party Insurance?

Small business third-party insurance, also known as liability insurance, is coverage that safeguards your business against claims made by third parties, such as customers, clients, or suppliers, for any damages or injuries caused by your business activities. This includes situations where your products or services have caused harm, property damage, or financial loss to others. Third-party insurance ensures that your business has the financial means to compensate for any damages claimed against it.

2 Picture Gallery: Safeguard Your Small Business With Comprehensive 3rd Party Insurance: Secure Your Future Today!

Who Needs Small Business 3rd Party Insurance?

Every small business can benefit from having third-party insurance. Regardless of the size or industry, any business that interacts with customers, provides services, or sells products should consider obtaining this insurance. Even the most cautious and well-managed businesses can face unforeseen circumstances and potential lawsuits. Third-party insurance provides the necessary protection and peace of mind for business owners to focus on their operations without the constant fear of litigation.

When Should You Obtain Small Business 3rd Party Insurance?

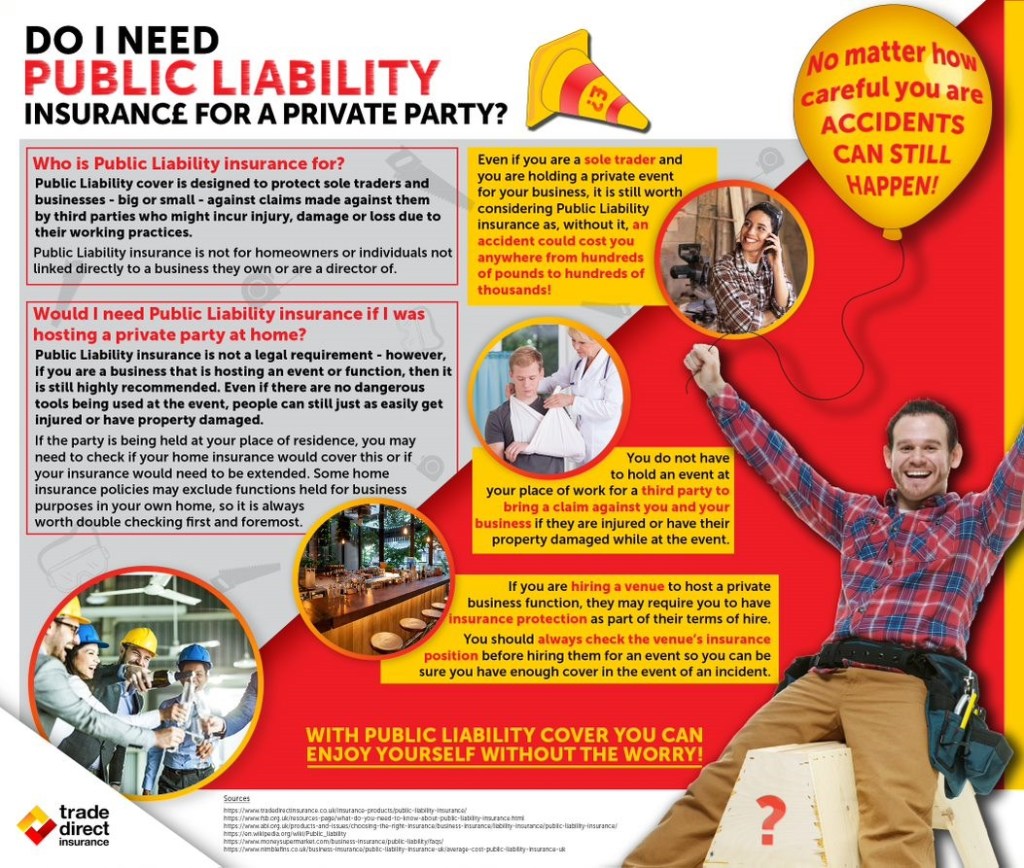

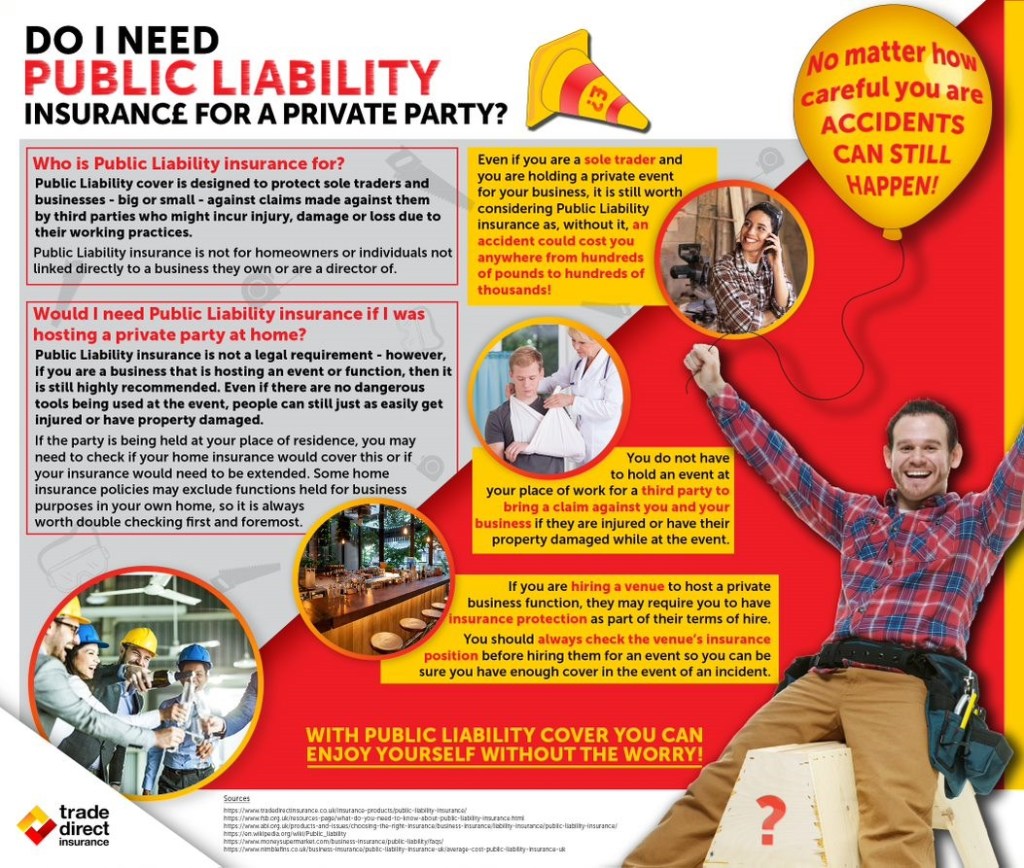

Image Source: tradedirectinsurance.co.uk

The ideal time to obtain third-party insurance for your small business is as soon as you start operations. It is crucial to have this coverage in place from the beginning to protect against any potential claims that may arise. Postponing insurance can expose your business to unnecessary risks. In some cases, clients or customers may require proof of insurance before entering into contracts or agreements with your business. Having third-party insurance readily available will not only satisfy these requirements but also enhance your credibility and reputation.

Where Can You Obtain Small Business 3rd Party Insurance?

There are various insurance providers and brokers that offer small business third-party insurance. It is advisable to research and compare different options to find the coverage that best suits your business needs. You can seek recommendations from other business owners in your industry or consult with insurance professionals who specialize in small business insurance. It is important to choose a reputable provider with a track record of excellent customer service and prompt claims processing.

Why is Small Business 3rd Party Insurance Essential?

Small business third-party insurance is essential for several reasons. Firstly, it protects your business from potential financial losses that may arise from legal claims. Without proper coverage, your business could be liable to pay substantial compensation or legal fees, which can be financially devastating. Additionally, having third-party insurance demonstrates your commitment to customer satisfaction and safety. It instills trust and confidence in your clients, showing that you are prepared to take responsibility for any unforeseen incidents.

How Does Small Business 3rd Party Insurance Work?

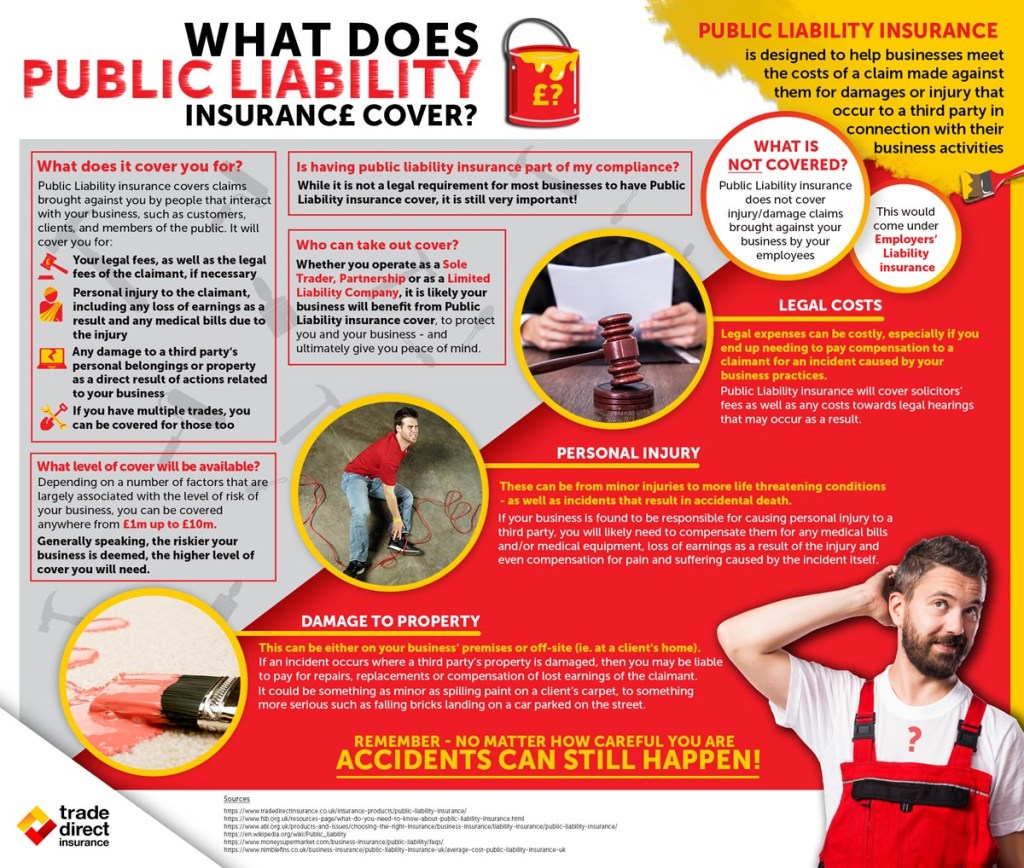

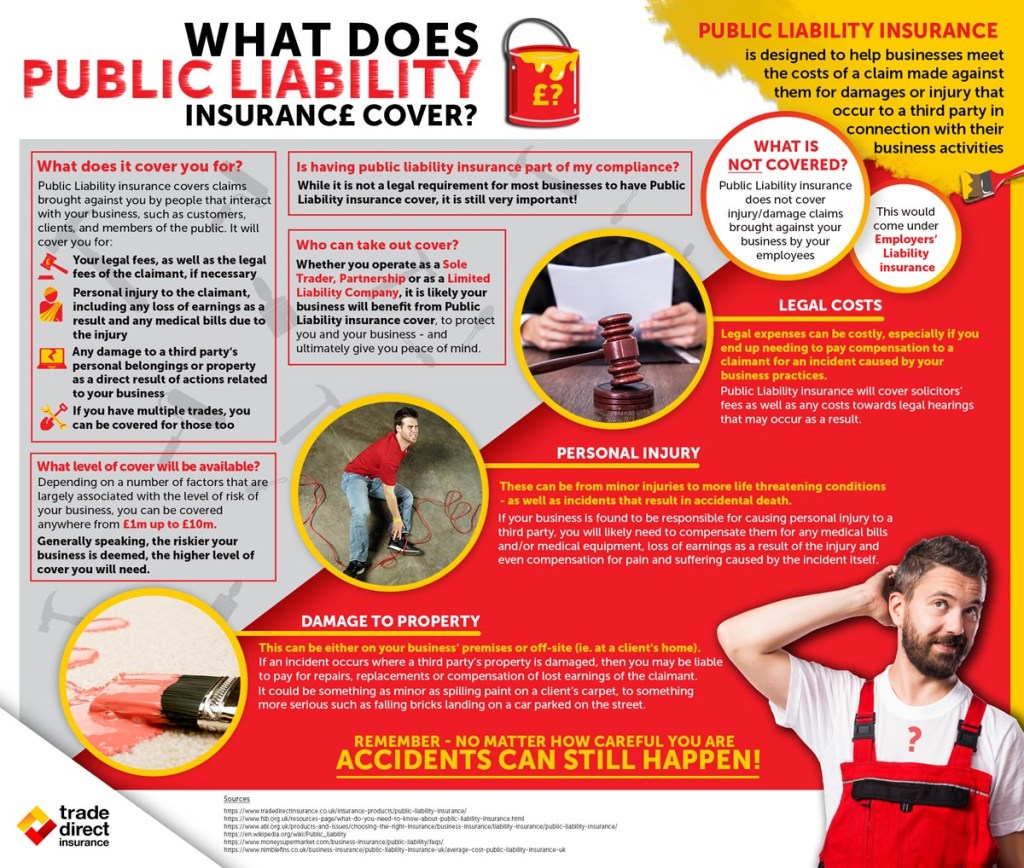

Image Source: tradedirectinsurance.co.uk

When an incident occurs that results in a third-party claim against your business, you will need to file a claim with your insurance provider. They will assess the claim and determine the coverage provided under your policy. If the claim is deemed valid, your insurance provider will handle the financial obligations, including legal representation, compensation, and any associated costs. It is essential to understand the terms and conditions of your policy and ensure that you comply with any reporting or documentation requirements to avoid potential claim denials.

FAQs about Small Business 3rd Party Insurance

Q: What does third-party insurance cover?

A: Third-party insurance covers the costs associated with legal claims made by third parties for damages or injuries caused by your business activities.

Q: Are there any exclusions to third-party insurance coverage?

A: Exclusions vary depending on the policy and insurance provider. It is essential to carefully review the terms and conditions to understand any specific exclusions that may apply to your coverage.

Q: How much does small business third-party insurance cost?

A: The cost of third-party insurance for a small business depends on various factors, including the size of your business, industry, coverage limits, and risk factors. It is recommended to obtain quotes from multiple insurance providers to find the most competitive rates.

The Benefits and Drawbacks of Small Business 3rd Party Insurance

Having small business third-party insurance offers numerous benefits, such as financial protection, legal representation, and enhanced reputation. It provides peace of mind, knowing that your business is protected from potential claims that can have a significant impact on your finances and operations. However, it is important to consider the potential drawbacks as well. The cost of insurance premiums can be a burden for some businesses, especially those with limited budgets. Additionally, understanding the terms and conditions of the policy and complying with reporting requirements may require additional administrative efforts.

Conclusion

Small business third-party insurance is a vital component of ensuring the longevity and success of your business. It protects your business from potential liabilities and claims, allowing you to focus on providing excellent products or services to your customers. I highly recommend obtaining third-party insurance from a reputable provider to safeguard your business and instill trust in your clientele. With the right insurance coverage, you can confidently navigate the complexities of business operations, knowing that you are adequately protected.

This post topic: Small Business