Maximize Your Small Business Tax Offset With Xero: Unlock Savings Today!

The Small Business Tax Offset Xero: Streamlining Your Tax Process

As a small business owner, one of the most daunting tasks can be dealing with taxes. From keeping track of expenses to ensuring compliance with ever-changing regulations, the process can be time-consuming and overwhelming. However, with the Small Business Tax Offset Xero, you can simplify and streamline your tax process, allowing you to focus on what you do best – running your business.

What is the Small Business Tax Offset Xero?

3 Picture Gallery: Maximize Your Small Business Tax Offset With Xero: Unlock Savings Today!

The Small Business Tax Offset Xero is a feature offered by the popular accounting software Xero. It is designed specifically for small business owners to help them claim tax deductions and credits, ultimately reducing their tax liabilities. The feature assists in automating the process of calculating and applying these offsets, saving both time and effort.

Who is Eligible for the Small Business Tax Offset Xero?

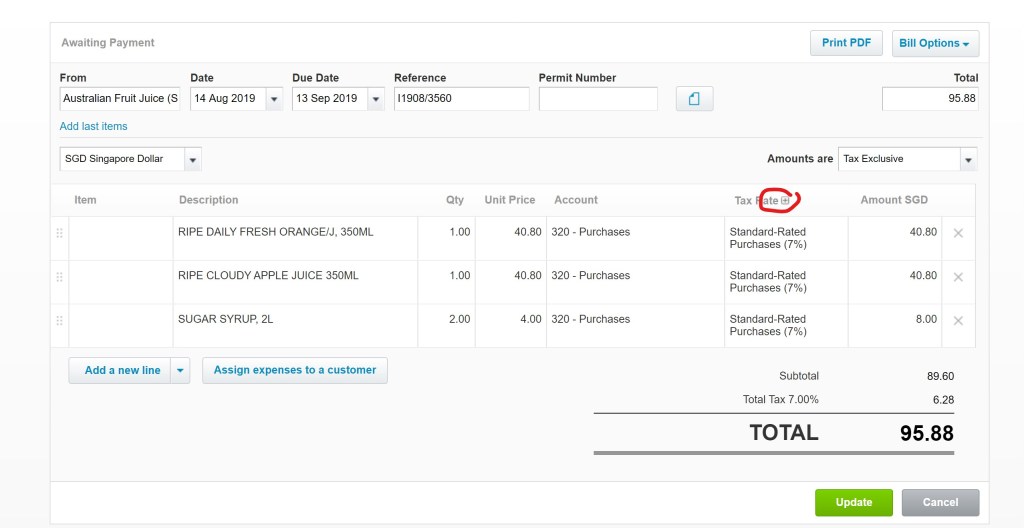

Image Source: i0.wp.com

The Small Business Tax Offset Xero is available to small businesses in Australia that have a yearly turnover of less than $50 million. This includes a wide range of businesses, such as sole traders, partnerships, and companies. Whether you’re a freelancer, a small retail shop, or a tech startup, you can benefit from this feature.

When Can You Claim the Small Business Tax Offset Xero?

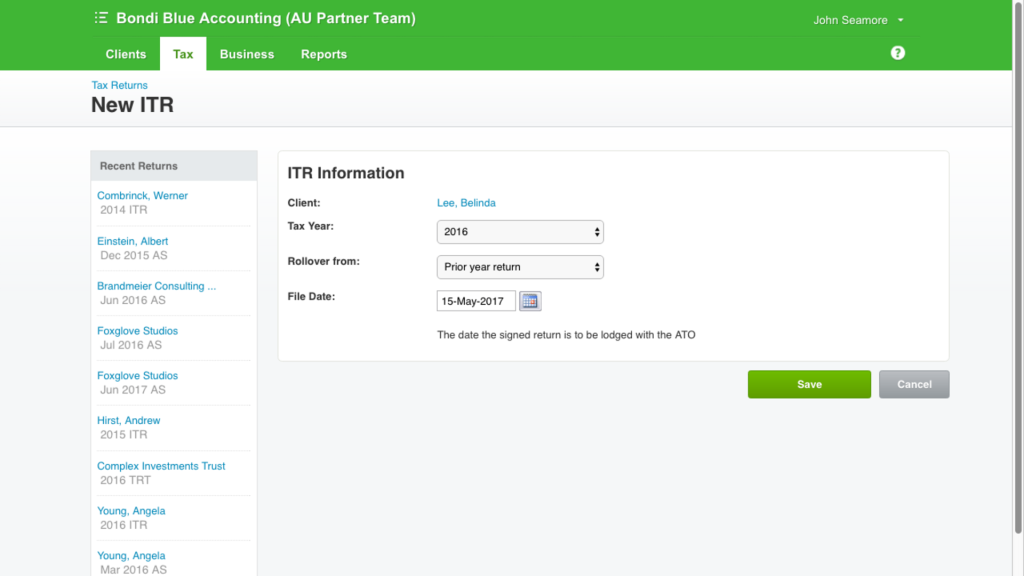

Image Source: xero.com

The Small Business Tax Offset Xero can be claimed in your annual income tax return. It is important to note that the offset is applicable for the financial year in which it is claimed. Therefore, it is crucial to stay up to date with the latest tax regulations and deadlines to ensure you don’t miss out on any potential savings.

Where Can You Access the Small Business Tax Offset Xero?

The Small Business Tax Offset Xero is a feature integrated into the Xero accounting software. Xero is a cloud-based platform, which means you can access it from anywhere with an internet connection. Simply log in to your Xero account, navigate to the tax section, and you’ll find the Small Business Tax Offset Xero ready for use.

Why Should You Use the Small Business Tax Offset Xero?

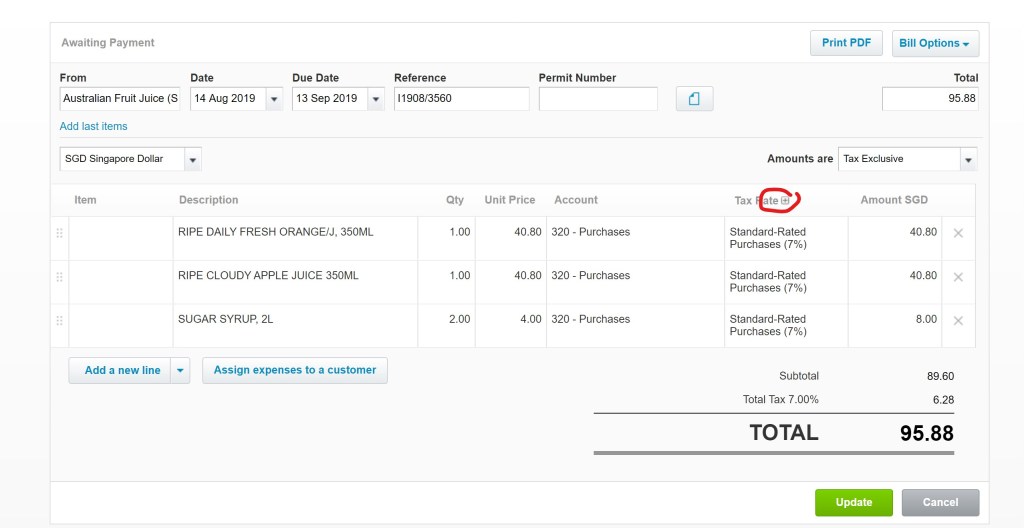

Image Source: xero.com

There are several reasons why you should consider using the Small Business Tax Offset Xero. Firstly, it simplifies the tax process, allowing you to save time and reduce stress. The feature automates calculations, ensuring accuracy and eliminating the risk of human error. Additionally, it helps you maximize your tax deductions and credits, ultimately reducing your tax liabilities. By taking advantage of this feature, you can optimize your financial situation and keep more money in your pocket.

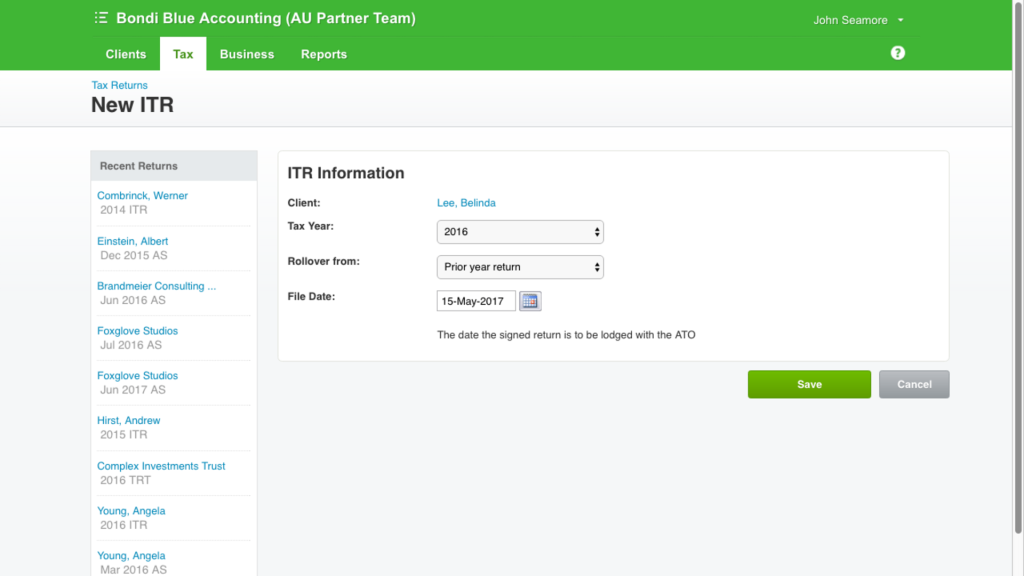

How Does the Small Business Tax Offset Xero Work?

The Small Business Tax Offset Xero works by analyzing your business transactions, categorizing them correctly, and applying the appropriate tax offsets. It uses artificial intelligence and machine learning algorithms to learn from your historical data, allowing for accurate predictions and recommendations. The feature also provides real-time updates on your tax position, giving you a clear understanding of your financial situation throughout the year.

Frequently Asked Questions about the Small Business Tax Offset Xero

Q: Can I use the Small Business Tax Offset Xero if I already have an accountant?

A: Absolutely! The Small Business Tax Offset Xero is designed to work alongside your existing accounting practices. It can be a valuable tool for both you and your accountant in streamlining the tax process.

Q: Is the Small Business Tax Offset Xero compatible with other accounting software?

A: Unfortunately, the Small Business Tax Offset Xero is only available within the Xero accounting software. However, Xero offers seamless integration with various applications and platforms, allowing you to transfer data effortlessly.

Q: How much does the Small Business Tax Offset Xero cost?

A: The cost of the Small Business Tax Offset Xero varies depending on your Xero subscription plan. It is recommended to visit the Xero website or contact their customer support for detailed pricing information.

The Pros and Cons of the Small Business Tax Offset Xero

Pros:

Efficient and time-saving tax process

Accurate calculations and recommendations

Real-time updates on your tax position

Maximizes tax deductions and credits

Integration with existing accounting practices

Cons:

Only available within the Xero accounting software

May require some learning curve for new users

Additional cost depending on your Xero subscription plan

Conclusion: Simplify Your Tax Process with the Small Business Tax Offset Xero

The Small Business Tax Offset Xero is a valuable tool for small business owners looking to streamline their tax process. With its automated calculations, accurate recommendations, and real-time updates, it simplifies the complex world of taxes. While it may have some limitations, its pros outweigh the cons, making it a worthwhile investment for any small business owner. Take advantage of the Small Business Tax Offset Xero and let it work its magic in reducing your tax liabilities, allowing you to focus on growing your business.

This post topic: Small Business