Unlock Your Success: Claim The Small Business Deduction 500,000 And Thrive!

Small Business Deduction 500,000: A Game-Changer for Entrepreneurs

As a budding entrepreneur, I have always been on the lookout for ways to maximize profits and minimize expenses. One of the most exciting discoveries I made recently is the small business deduction of $500,000. This deduction has been a game-changer for small business owners like me, allowing us to invest more in our ventures and fuel economic growth. In this article, I will delve into the what, who, when, where, why, and how of the small business deduction 500,000, providing you with all the information you need to take advantage of this incredible opportunity.

What is the Small Business Deduction 500,000?

The small business deduction 500,000 is a tax benefit provided by the government to eligible small businesses. It allows entrepreneurs to deduct up to $500,000 from their taxable income, resulting in significant tax savings. This deduction is a part of the Small Business Jobs Act, which aims to stimulate economic growth by providing tax relief to small businesses.

2 Picture Gallery: Unlock Your Success: Claim The Small Business Deduction 500,000 And Thrive!

Who is Eligible for the Small Business Deduction 500,000?

The small business deduction is available to businesses that meet certain criteria. To be eligible, your business must have an annual gross revenue of less than $5 million. Furthermore, the deduction is applicable to both sole proprietorships and pass-through entities, such as partnerships and S-corporations. However, it is important to consult with a tax professional or accountant to determine your eligibility and ensure compliance with all relevant regulations.

When and Where Can You Claim the Small Business Deduction?

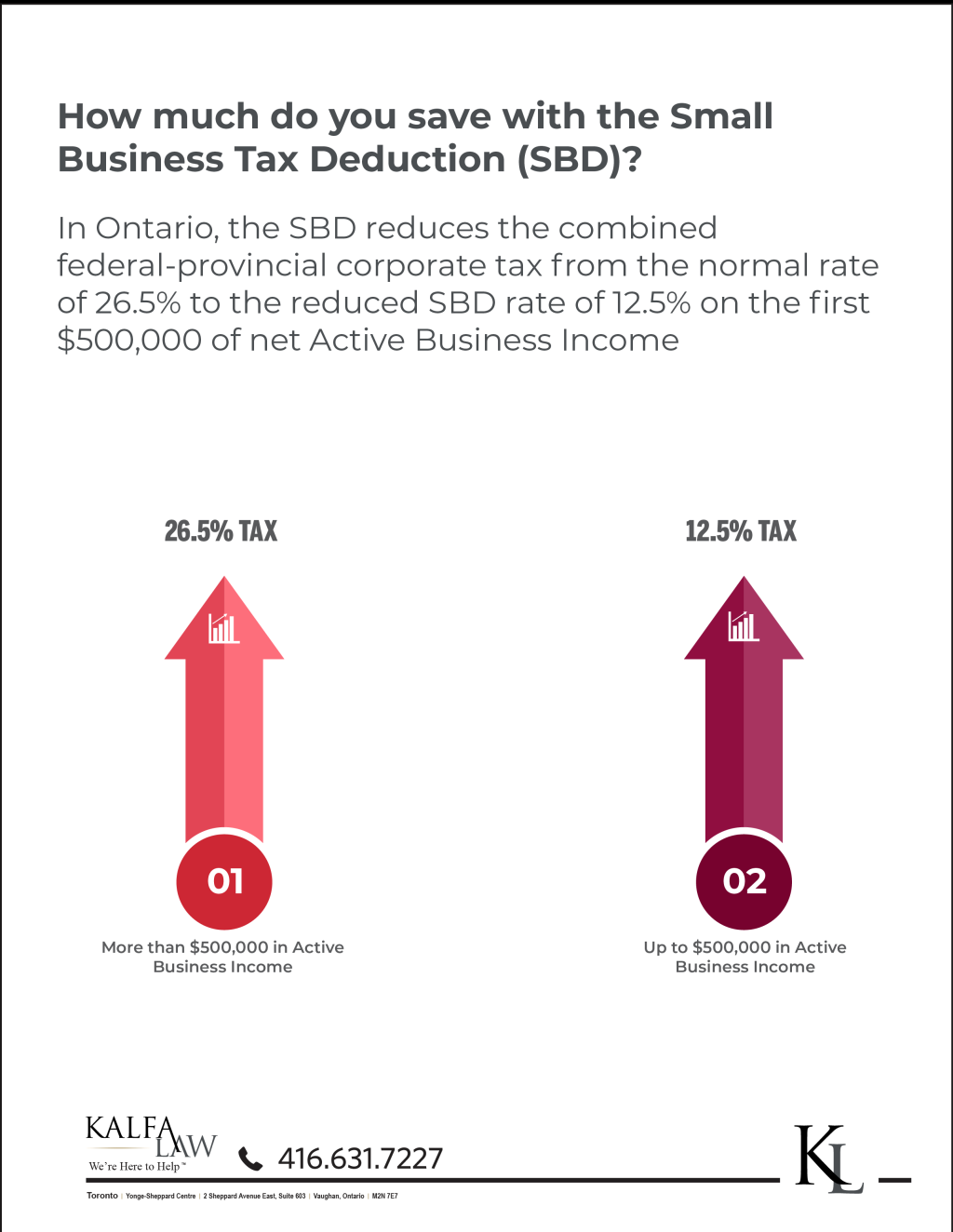

Image Source: kalfalaw.com

The small business deduction can be claimed when filing your annual tax return. It is typically claimed on Schedule C (Form 1040) for sole proprietors, or on the appropriate tax forms for pass-through entities. It is important to note that the deduction is only available for businesses that are based in the United States and generate income within the country.

Why Should Small Businesses Take Advantage of this Deduction?

The small business deduction 500,000 offers numerous benefits to entrepreneurs. Firstly, it allows for significant tax savings, which can be reinvested into the business for growth and expansion. Additionally, it provides small businesses with a competitive advantage by reducing their tax liabilities, allowing them to allocate more resources to innovation and market development. Moreover, the deduction encourages entrepreneurship and job creation, as it incentivizes individuals to start their own businesses and contribute to the economy.

How Can Small Businesses Make the Most of the Deduction?

To make the most of the small business deduction 500,000, it is crucial to keep meticulous records of all business expenses and income. This includes maintaining accurate financial statements, receipts, and invoices. By organizing your financial records, you can easily calculate the deductible amount and ensure compliance with tax regulations. Additionally, consulting with a tax professional or accountant can provide valuable insights into maximizing the deduction and optimizing your overall tax strategy.

FAQs About Small Business Deduction 500,000

Q: Can I claim the small business deduction if my revenue exceeds $5 million?

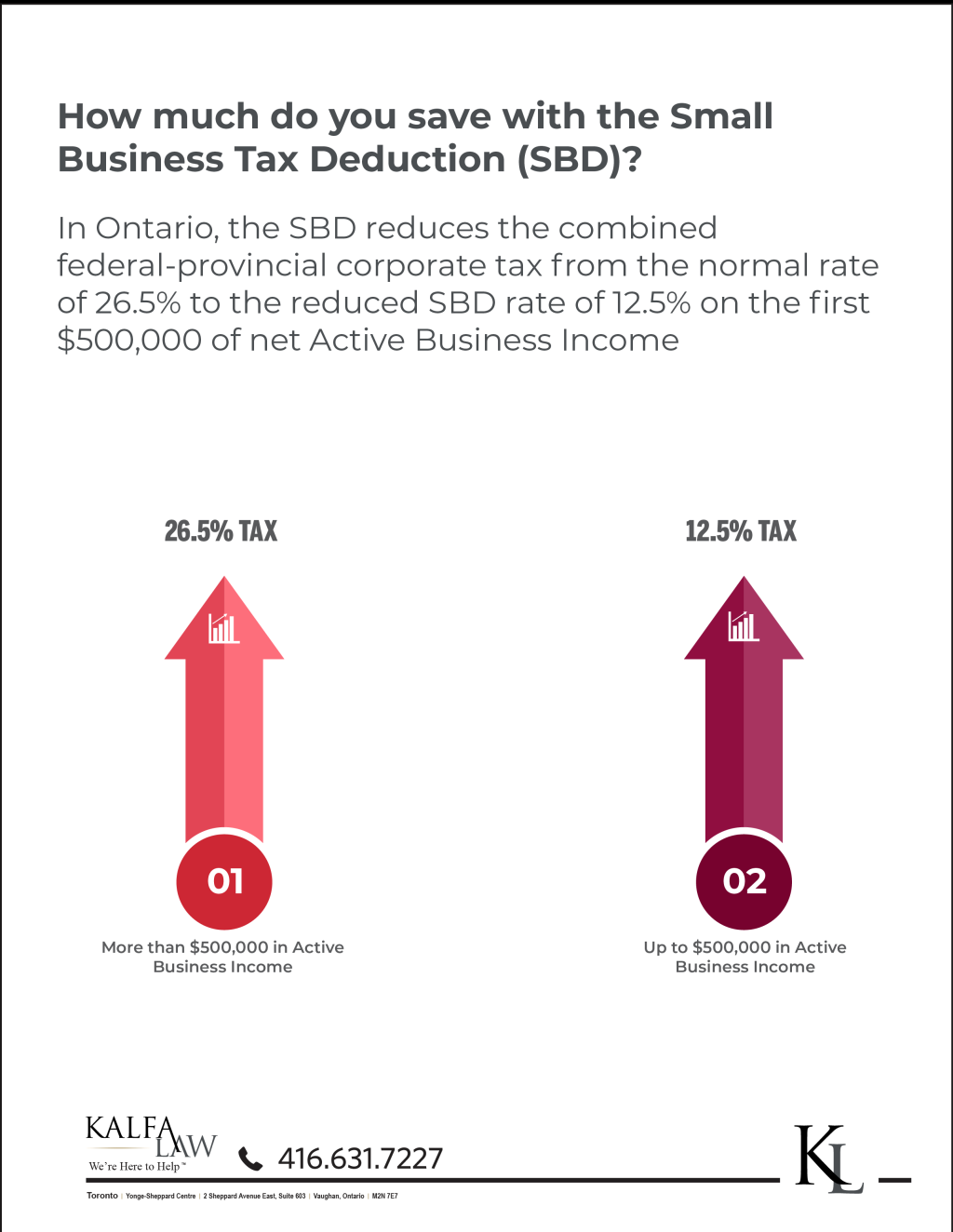

Image Source: kalfalaw.com

A: No, the small business deduction is only available to businesses with annual gross revenue of less than $5 million.

Q: Can I retroactively claim the deduction for previous tax years?

A: No, the small business deduction can only be claimed for the current tax year and cannot be applied retroactively.

Q: Are there any restrictions on how I can use the tax savings from the deduction?

A: There are no specific restrictions on how you can use the tax savings. However, it is advisable to reinvest the savings back into your business for growth and expansion.

Q: What happens if my business revenue exceeds $5 million during the tax year?

A: If your business revenue exceeds $5 million during the tax year, you will no longer be eligible for the small business deduction. It is important to monitor your revenue and adjust your tax strategy accordingly.

The Pros and Cons of the Small Business Deduction 500,000

Pros:

– Significant tax savings for eligible small businesses

– Encourages entrepreneurship and job creation

– Allows for reinvestment in business growth and expansion

Cons:

– Limited to businesses with annual gross revenue of less than $5 million

– Requires meticulous record-keeping and compliance with tax regulations

– Can be subject to changes in tax laws and regulations

Conclusion: A Game-Changing Opportunity for Small Businesses

The small business deduction 500,000 is undoubtedly a game-changer for entrepreneurs. It provides tax relief, encourages economic growth, and empowers small businesses to thrive. By taking advantage of this deduction, entrepreneurs can allocate more resources to innovation, job creation, and overall business development. However, it is crucial to consult with a tax professional or accountant to ensure compliance with all regulations and maximize the benefits of this incredible opportunity. As a small business owner who has experienced firsthand the positive impact of this deduction, I highly recommend exploring this tax benefit and leveraging it to propel your business forward.

This post topic: Small Business