The Ultimate Small Business 30 Day Payment Policy: Boost Your Cash Flow Today!

The Small Business 30 Day Payment Policy: A Game-Changer for Entrepreneurs

As a small business owner, I have come to understand the importance of implementing effective payment policies. One such policy that has revolutionized the way I conduct business is the Small Business 30 Day Payment Policy. This policy has not only allowed me to streamline my financial processes but has also improved cash flow and strengthened relationships with my clients. In this article, I will delve into the details of this policy, discussing what it entails, who it benefits, when and where it can be implemented, why it is crucial for small businesses, and how it can be effectively enforced.

What is the Small Business 30 Day Payment Policy?

The Small Business 30 Day Payment Policy refers to a payment term agreement between a small business and its customers, wherein the payment for goods or services rendered is due within 30 days from the invoice date. This policy sets a standard payment timeframe that allows small businesses to maintain a steady cash flow, while also providing customers with sufficient time to settle their accounts.

3 Picture Gallery: The Ultimate Small Business 30 Day Payment Policy: Boost Your Cash Flow Today!

Who Benefits from the Small Business 30 Day Payment Policy?

The Small Business 30 Day Payment Policy benefits both small business owners and their customers. For small business owners, it ensures a predictable and consistent inflow of funds, enabling them to meet their financial obligations and invest in business growth. On the other hand, customers appreciate the extended payment period as it provides them with flexibility in managing their finances without compromising their relationship with the small business.

When and Where Can the Small Business 30 Day Payment Policy be Implemented?

Image Source: templatelab.com

The Small Business 30 Day Payment Policy can be implemented across various industries and sectors. Whether you are a consultant, a freelancer, a supplier, or a service provider, this policy can be customized to fit your specific business needs. It can be applied to both B2B (business-to-business) and B2C (business-to-consumer) transactions, making it a versatile tool for small business owners in any market.

Why is the Small Business 30 Day Payment Policy Crucial for Small Businesses?

Small businesses often face cash flow challenges, with delayed payments affecting their ability to cover expenses and grow their ventures. The Small Business 30 Day Payment Policy addresses this issue by establishing a clear payment timeline, reducing the risk of late or unpaid invoices. By ensuring prompt payment, small businesses can avoid liquidity problems, maintain healthy financials, and focus on providing quality products or services to their customers.

How to Effectively Enforce the Small Business 30 Day Payment Policy?

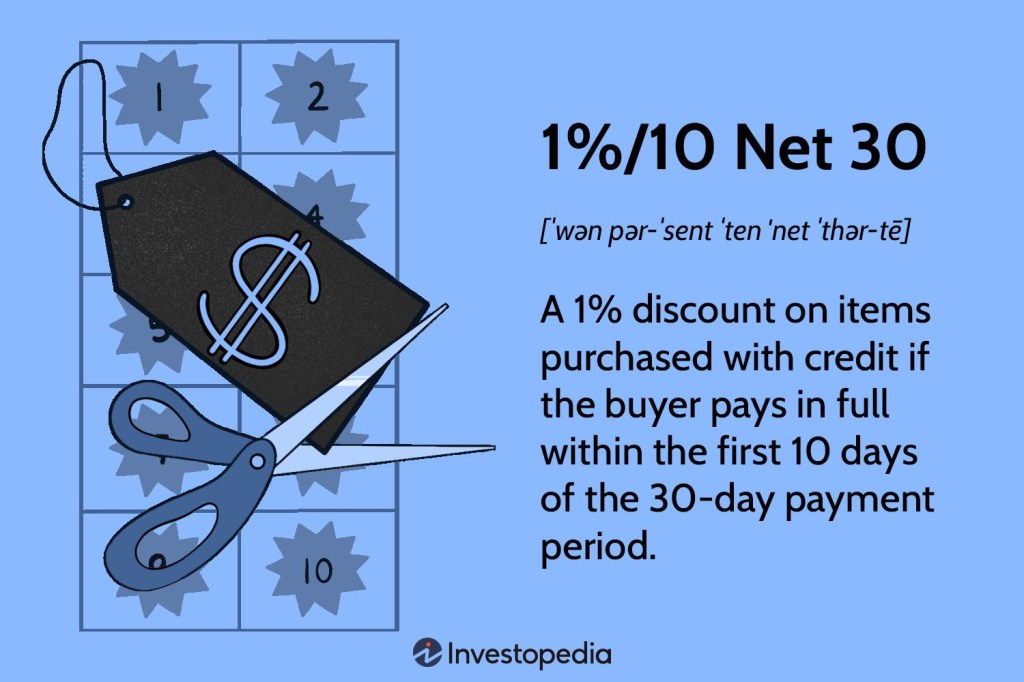

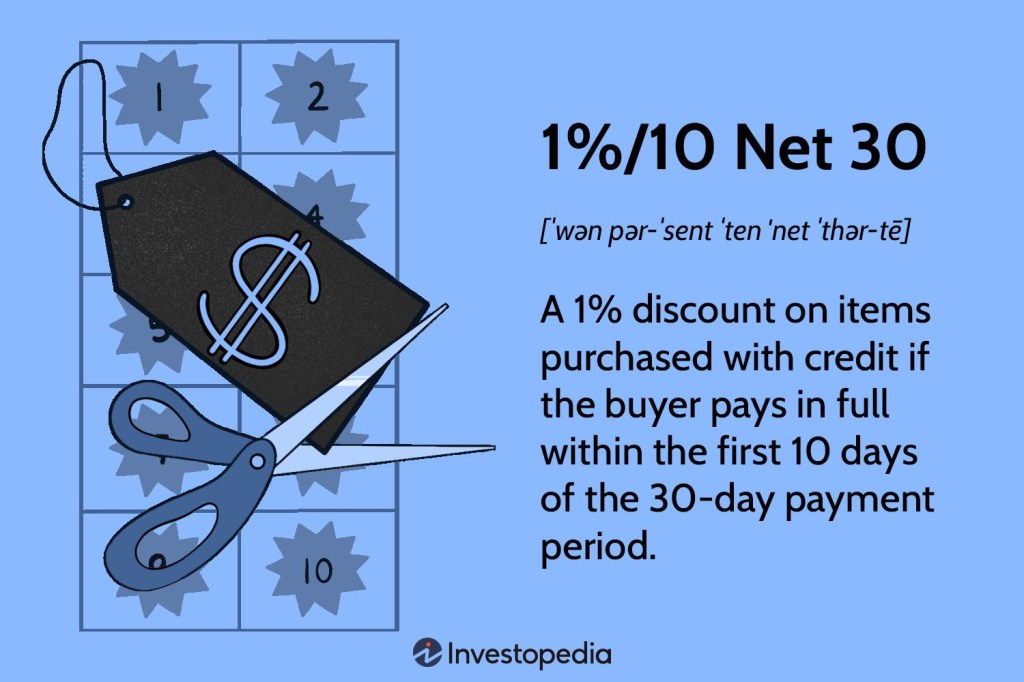

Enforcing the Small Business 30 Day Payment Policy requires effective communication and transparency with clients or customers. Clearly communicate the payment terms upfront, whether it is through invoices, contracts, or agreements. Incentivize early payments by offering discounts or rewards, and establish consequences for late payments, such as late fees or reduced services. Additionally, implementing an automated invoicing and payment system can streamline the process and ensure timely payments.

FAQs About the Small Business 30 Day Payment Policy:

Q: Can I customize the payment timeframe?

Image Source: eforms.com

A: Absolutely! The Small Business 30 Day Payment Policy can be customized to suit your business needs. Some businesses may opt for a shorter or longer payment period depending on industry norms or individual circumstances.

Q: What if a customer fails to make payment within 30 days?

A: In such cases, it is essential to follow up with the customer promptly. Send reminders, make courtesy calls, and escalate the matter if necessary. Consider implementing penalties for late payments to encourage prompt settlement.

Q: Will the Small Business 30 Day Payment Policy negatively affect customer relationships?

A: On the contrary, implementing this policy enhances transparency and professionalism in your business dealings. Customers appreciate clear expectations and will perceive your business as organized and reliable.

The Pros and Cons of the Small Business 30 Day Payment Policy

Image Source: investopedia.com

Pros:

Improved cash flow

Established payment expectations

Reduced risk of late or unpaid invoices

Better financial planning

Enhanced client relationships

Cons:

Potential strain on customer relationships if not communicated effectively

Delayed revenue for the business

Requires diligent follow-up for late payments

Conclusion: A Game-Changer for Small Businesses

The Small Business 30 Day Payment Policy has proven to be a game-changer for entrepreneurs like myself. By setting clear payment expectations, it has empowered me to navigate the financial landscape of my business more effectively. Not only does it ensure a steady cash flow, but it also fosters transparency, trust, and professionalism in my customer relationships. If you are a small business owner looking to optimize your payment processes and improve cash flow, I highly recommend implementing the Small Business 30 Day Payment Policy. It just might be the solution you have been searching for.

This post topic: Small Business