Boost Your Small Business In 2023 With An Effective Budget: Get Started Now!

Small Business 2023 Budget: Preparing for Success

As a budding entrepreneur, one of the most crucial aspects of running a small business is managing your finances effectively. The small business budget plays a vital role in determining the success and growth of your venture. In this article, I will share my insights and experiences regarding the small business 2023 budget, offering valuable tips and advice to help you make the most of your financial resources.

Understanding the Small Business 2023 Budget

Before delving into the details, let’s first define what the small business 2023 budget entails. It refers to the financial plan that outlines your projected revenues and expenses for the upcoming year. A well-prepared budget provides a comprehensive overview of your business’s financial situation and allows you to make informed decisions regarding expenditures, investments, and potential growth opportunities.

2 Picture Gallery: Boost Your Small Business In 2023 With An Effective Budget: Get Started Now!

What is the Purpose of the Small Business 2023 Budget?

The primary purpose of the small business 2023 budget is to ensure that your company operates within its financial means while maximizing profitability. By setting clear financial goals and allocating resources accordingly, you can track your progress and identify areas that require adjustment or improvement. Additionally, a budget helps you anticipate cash flow fluctuations, plan for upcoming expenses, and make strategic decisions to achieve long-term success.

Who Should Prepare the Small Business 2023 Budget?

Image Source: businessconnectindia.in

As a small business owner, it is crucial to be actively involved in the budgeting process. While you may seek assistance from a professional accountant or financial advisor, you should have a thorough understanding of your company’s financials to make informed decisions. By taking an active role in creating the budget, you gain a deeper understanding of your business’s financial health and can make adjustments as needed.

When Should You Create the Small Business 2023 Budget?

The small business 2023 budget should ideally be created well in advance to ensure a smooth transition into the new year. It is recommended to start the budgeting process at least a few months before the end of the current fiscal year. This timeframe allows you to evaluate the performance of your business, analyze market trends, and incorporate any changes or adjustments necessary for the upcoming year.

Where to Begin with the Small Business 2023 Budget?

Getting started with the small business 2023 budget can feel overwhelming, but breaking it down into manageable steps can simplify the process. Begin by gathering all relevant financial data, such as sales records, expense reports, and cash flow statements. Analyze this information to identify patterns, trends, and areas that require improvement. Use this data as a foundation for creating realistic revenue and expense projections for the upcoming year.

Why is the Small Business 2023 Budget Important?

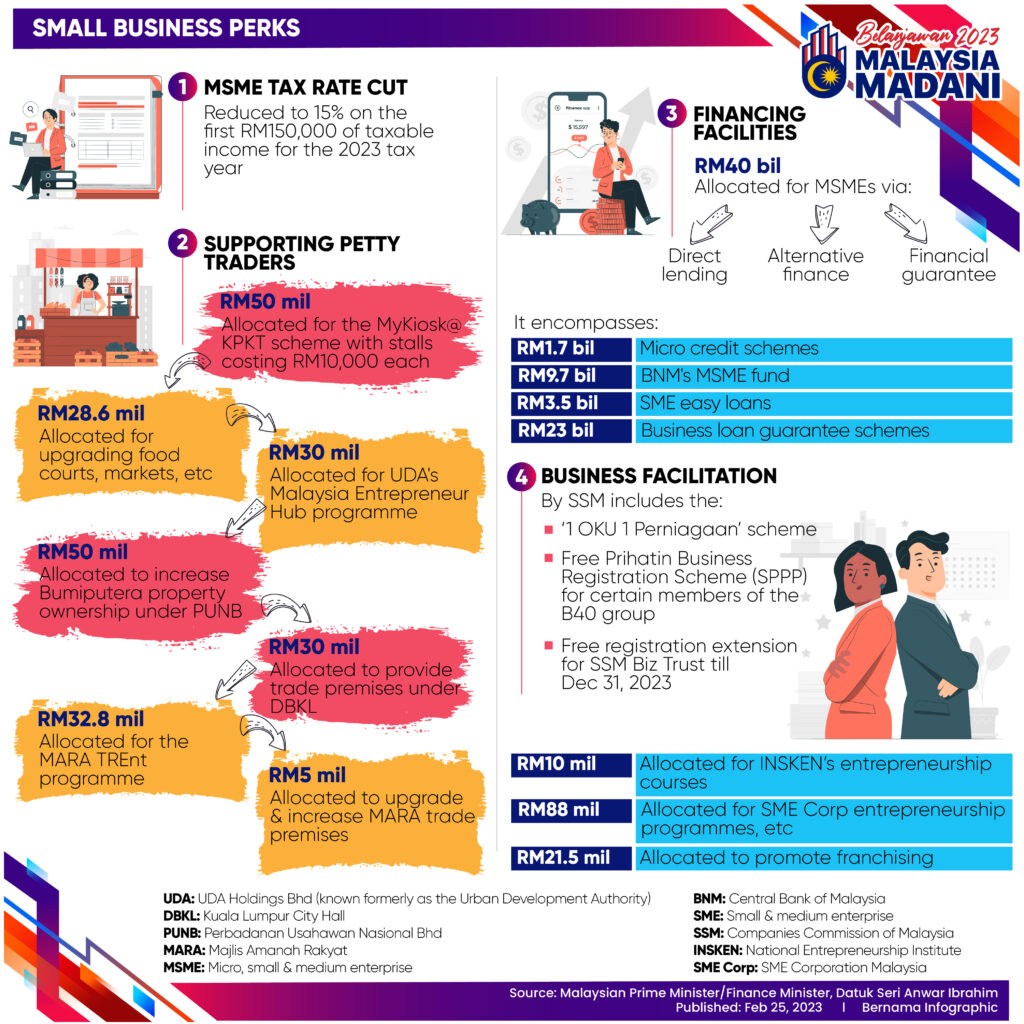

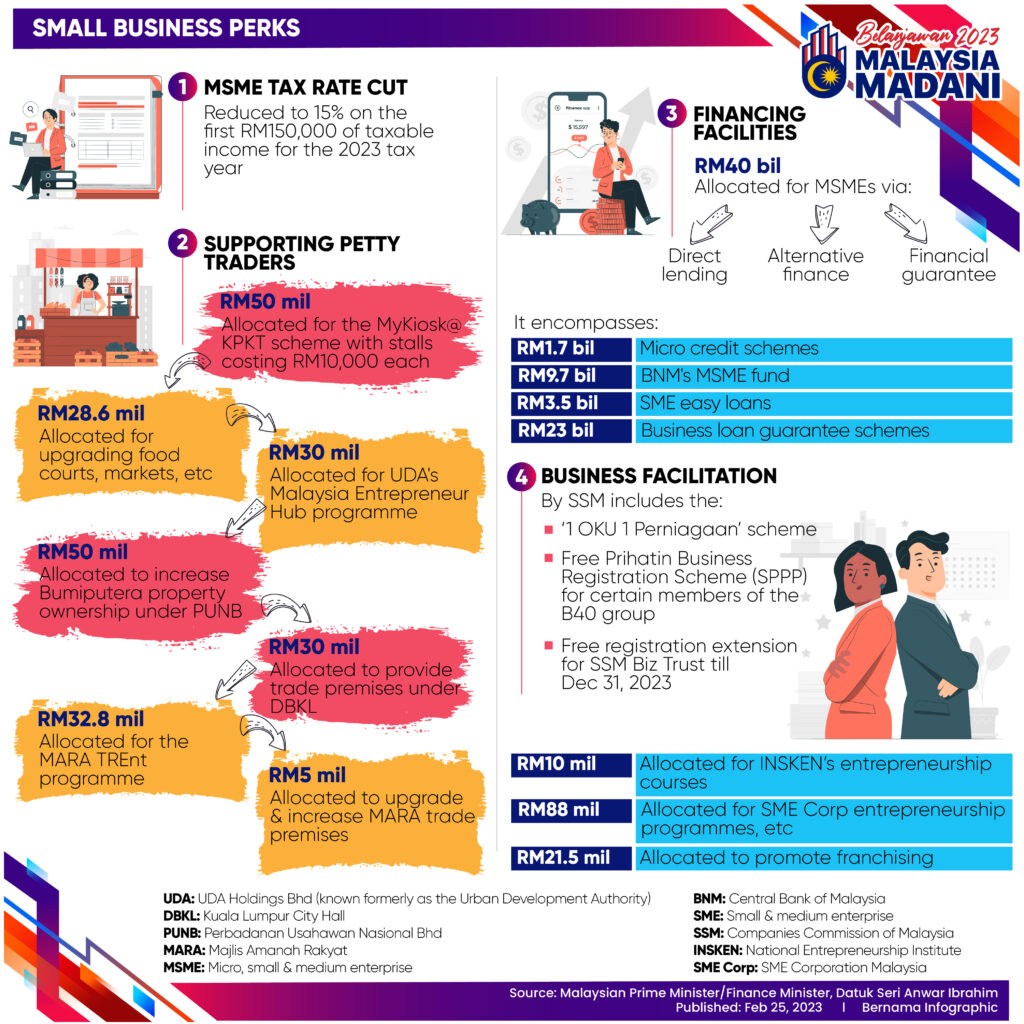

Image Source: pmo.gov.my

The small business 2023 budget is essential for several reasons. Firstly, it provides a clear roadmap for your business, outlining your financial goals and how to achieve them. Secondly, it helps you allocate resources effectively, ensuring that you have sufficient funds for day-to-day operations, investments, and growth opportunities. Additionally, a budget enables you to track your progress, identify potential challenges, and make proactive decisions to mitigate risks.

How to Create an Effective Small Business 2023 Budget?

Creating an effective small business 2023 budget requires careful planning and attention to detail. Here are some steps to guide you through the process:

Evaluate past performance: Review your previous financial statements to identify trends, patterns, and areas that need improvement.

Set realistic goals: Define your financial objectives for the upcoming year, considering both short-term and long-term targets.

Estimate revenues: Project your expected sales based on market research, historical data, and anticipated changes in demand.

Identify expenses: Categorize your expenses into fixed and variable costs, including rent, utilities, salaries, marketing, and supplies.

Allocate resources: Determine how much of your budget should be allocated to different areas of your business, such as marketing, operations, and growth initiatives.

Monitor and adjust: Regularly review your budget and compare it to actual financial results. Make necessary adjustments to stay on track.

FAQs about Small Business 2023 Budget

Q: What are the benefits of creating a small business budget?

A: A small business budget helps you gain a clear understanding of your financial situation, make informed decisions, allocate resources effectively, and track your progress towards achieving your goals.

Q: How often should I review and update my small business budget?

A: It is advisable to review your budget on a monthly or quarterly basis to compare it with actual financial results. Regular updates ensure that you can adapt to changing market conditions and make necessary adjustments.

Q: Are there any disadvantages to creating a small business budget?

A: While budgeting provides numerous benefits, it can be time-consuming and require careful attention to detail. Additionally, unexpected events or market fluctuations can impact your budget, requiring flexibility and adjustment.

Conclusion

The small business 2023 budget is a critical tool for success in the ever-changing business landscape. By creating a well-thought-out budget, you can effectively manage your finances, make informed decisions, and stay on track towards achieving your goals. Remember to regularly monitor and adjust your budget as needed and seek professional advice if necessary. With a solid budget in place, your small business is poised for financial success in the coming year.

This post topic: Small Business