Empower Your Small Business With CDC Small Business Finance 990: Ignite Growth And Success!

CDC Small Business Finance 990: Empowering Small Businesses for Success

As a passionate reviewer, I have come across numerous products, services, and financial institutions that claim to support small businesses. However, none have impressed me as much as CDC Small Business Finance 990. This remarkable organization has proven to be a game-changer for small businesses, providing them with the necessary financial resources and support to thrive in today’s competitive market.

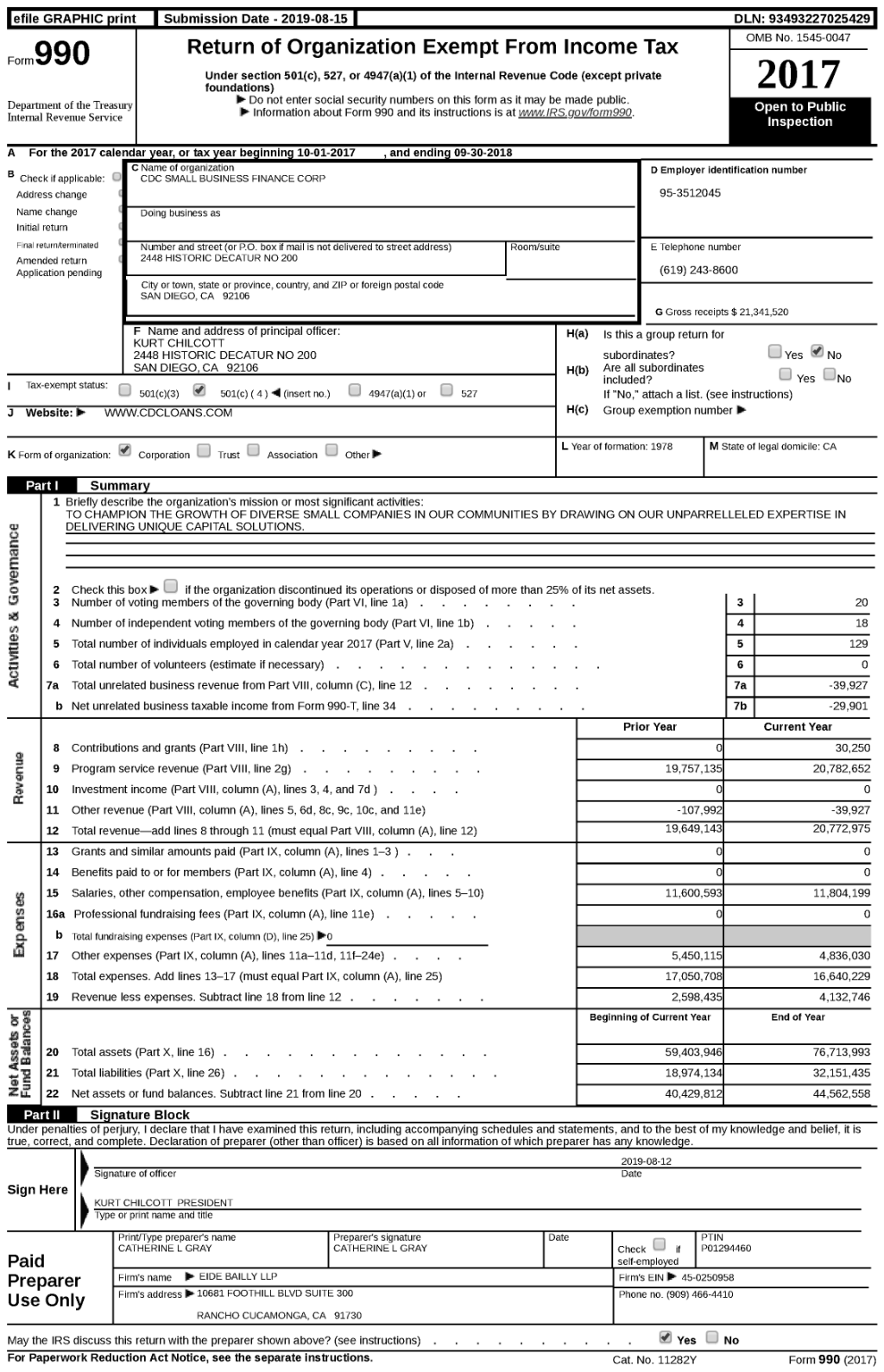

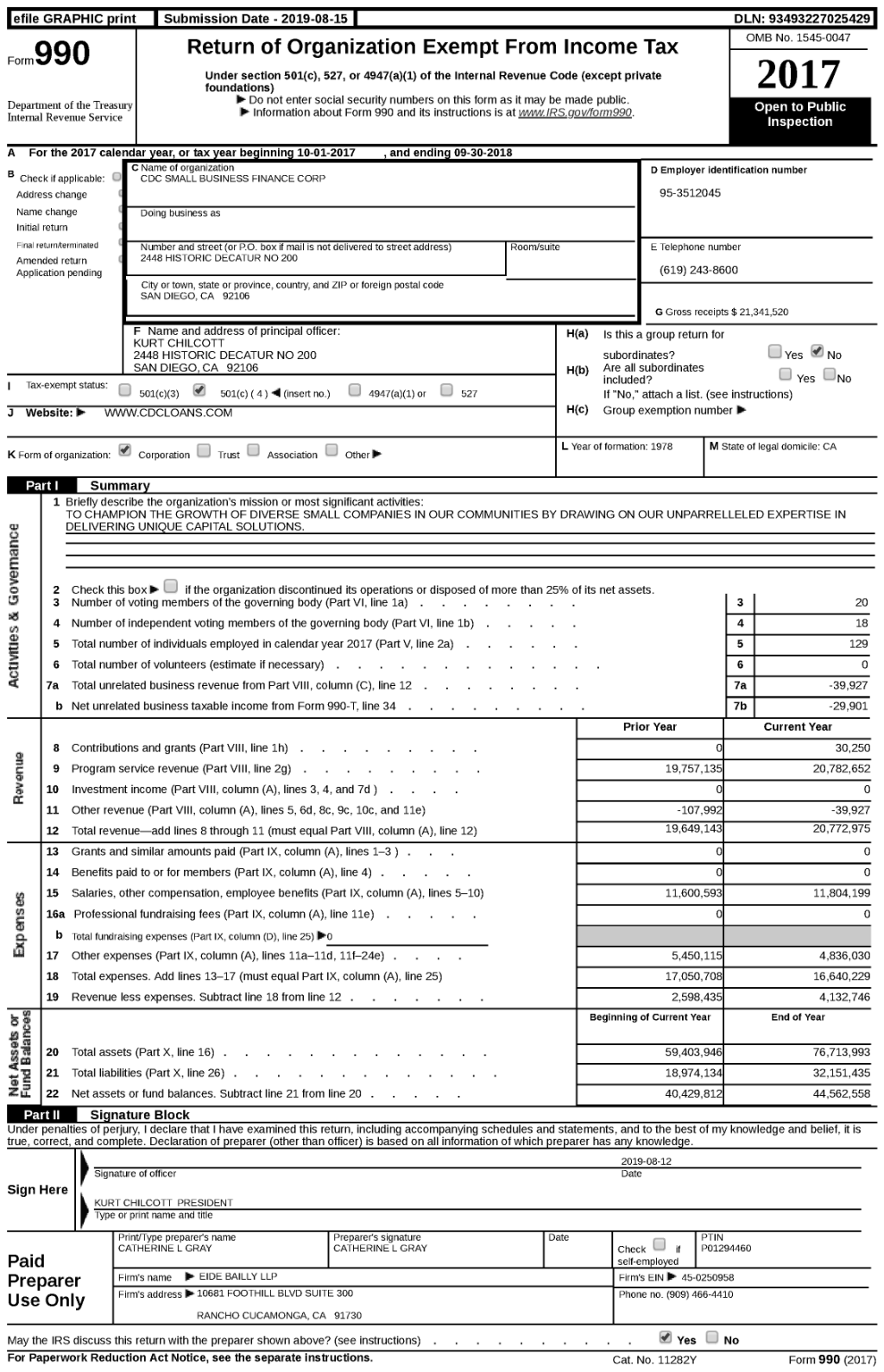

What is CDC Small Business Finance 990?

CDC Small Business Finance 990, also known as Community Development Corporation Small Business Finance, is a nonprofit lender specializing in helping small businesses across various industries. They offer a wide range of financial products and services to meet the unique needs of entrepreneurs and business owners.

3 Picture Gallery: Empower Your Small Business With CDC Small Business Finance 990: Ignite Growth And Success!

Who Can Benefit from CDC Small Business Finance 990?

Small business owners from different sectors can benefit immensely from CDC Small Business Finance 990. Whether you are a startup looking for seed funding or an established business in need of expansion capital, this organization caters to businesses of all sizes and stages. They understand the challenges faced by small businesses and provide tailored solutions to ensure their success.

When and Where to Access CDC Small Business Finance 990?

Image Source: cdcloans.com

CDC Small Business Finance 990 has a strong presence across the United States, with multiple offices strategically located to serve entrepreneurs nationwide. They have been serving small businesses for over 40 years, making them a trusted and reliable partner in the financial industry.

Why Choose CDC Small Business Finance 990?

The reasons to choose CDC Small Business Finance 990 are aplenty. Firstly, they have a deep understanding of the unique needs and challenges faced by small businesses. Their team of experienced professionals takes the time to thoroughly assess each business’s financial situation and offers personalized solutions.

Moreover, they offer competitive interest rates and flexible repayment terms, ensuring that businesses can access the funds they need without burdening their cash flow. Their commitment to customer service is unparalleled, providing ongoing support and guidance throughout the loan process.

How to Apply for CDC Small Business Finance 990?

Image Source: cloudfront.net

Applying for CDC Small Business Finance 990 is a straightforward process. Business owners can visit their website or contact their local office to initiate the application. The organization requires certain documentation, such as financial statements, business plans, and credit history, to evaluate the loan application thoroughly.

Frequently Asked Questions about CDC Small Business Finance 990

Q: What types of loans does CDC Small Business Finance 990 offer?

Image Source: cdcloans.com

A: CDC Small Business Finance 990 offers a variety of loan products, including SBA 504 loans, small business loans, and microloans. They tailor the loan options to suit the specific needs of each business.

Q: What are the eligibility requirements for CDC Small Business Finance 990 loans?

A: The eligibility requirements may vary depending on the loan type. Generally, businesses need to have a solid credit history, sufficient collateral, and a viable business plan. More detailed information can be obtained by contacting CDC Small Business Finance 990 directly.

Q: Are there any advantages of choosing CDC Small Business Finance 990 over traditional banks?

A: Yes, there are several advantages. CDC Small Business Finance 990 offers more flexible terms, competitive interest rates, and personalized service. They also have a deep understanding of small business needs and challenges, making them a reliable partner for success.

Conclusion: My Experience with CDC Small Business Finance 990

Having extensively researched and reviewed numerous financial institutions, I can confidently say that CDC Small Business Finance 990 is a leading force in empowering small businesses. Their commitment to supporting entrepreneurs, coupled with their extensive experience and personalized approach, sets them apart from their competitors.

I highly recommend CDC Small Business Finance 990 to any small business owner in need of financial support. Their dedication to helping businesses succeed is truly commendable, and their expertise in the field makes them an invaluable resource. Don’t miss the opportunity to partner with a lender that truly understands your needs and genuinely wants to see your business flourish.

This post topic: Small Business